How to Start a Currency Trading Business

If you’ve ever traveled outside the country, you know exchange rates can kill you, but only if the foreign currency is worth more than your home country’s currency. For example, if $1 will only buy £0.70, then you’re effectively «trading down,» assuming costs for goods and services are relatively equal in both countries.

But, you can take advantage of these same exchange rates, and make a profit, if you own a currency trading business. Foreign exchange trading involves buying and selling foreign currency to make money off an international foreign exchange market. Since the value of the world’s currencies are constantly changing, the purpose of the business is to time the buying and selling of currencies, trading one against another, so that the company profits from currency swings with minimal losses (called «drawdown»).

You may also be interested in additional home business ideas.

Learn how to start your own Currency Trading Business and whether it is the right fit for you.

Ready to form your LLC? Check out the Top LLC Formation Services.

Start a currency trading business by following these 10 steps:

- Plan your Currency Trading Business

- Form your Currency Trading Business into a Legal Entity

- Register your Currency Trading Business for Taxes

- Open a Business Bank Account & Credit Card

- Set up Accounting for your Currency Trading Business

- Get the Necessary Permits & Licenses for your Currency Trading Business

- Get Currency Trading Business Insurance

- Define your Currency Trading Business Brand

- Create your Currency Trading Business Website

- Set up your Business Phone System

We have put together this simple guide to starting your currency trading business. These steps will ensure that your new business is well planned out, registered properly and legally compliant.

Exploring your options? Check out other small business ideas.

STEP 1: Plan your business

A clear plan is essential for success as an entrepreneur. It will help you map out the specifics of your business and discover some unknowns. A few important topics to consider are:

- What will you name your business?

- What are the startup and ongoing costs?

- Who is your target market?

- How much can you charge customers?

Luckily we have done a lot of this research for you.

What will you name your business?

Choosing the right name is important and challenging. If you don’t already have a name in mind, visit our How to Name a Business guide or get help brainstorming a name with our Currency Trading Business Name Generator

If you operate a sole proprietorship, you might want to operate under a business name other than your own name. Visit our DBA guide to learn more.

When registering a business name, we recommend researching your business name by checking:

- Your state’s business records

- Federal and state trademark records

- Social media platforms

- Web domain availability.

It’s very important to secure your domain name before someone else does.

Want some help naming your currency trading business?

Business Name Generator

What are the costs involved in opening a currency trading business?

The costs for starting a currency trading business are minimal. All you need is a computer and access to a FOREX trading platform. Expect to pay between $500 and $2,500 for a computer. Higher end computers are sometimes necessary if you plan on doing high volume trading. In this case, your computer costs could exceed $5,000-$10,000.

What are the ongoing expenses for a currency trading business?

Ongoing expenses for a currency trading business include a fast internet connection and computer maintenance, including regular software upgrades. Even with these costs, you should pay no more than $1,000 per year. If you are a broker, your costs may exceed several thousand dollars per month in server costs, software maintenance and upgrades, and servicing traders who use your platform.

Who is the target market?

If you are running a currency trading business for yourself, you have no customers. If you grow into a broker or market-maker, your customers are other traders and sometimes other brokers.

How does a currency trading business make money?

Currency trading businesses make money from the rise in currencies they invest in. Specifically, traders hope that the price of the currency they just bought will rise relative to the one they just sold. If you are a broker, you charge other traders a fixed or variable spread commission for trading. Some companies act as «pass through» entities for large market-makers, and only charge a fraction of a pip commission so that their traders can pay a thin spread that is only usually offered to very large or institutional investors.

How much can you charge customers?

If you are brokering for other traders, you can charge between 0 and 4 pips per trade. Since this is a very competitive industry, if you charge higher than the average for brokers, make sure you offer value-added services for traders.

How much profit can a currency trading business make?

If you are trading currencies, your revenues can fluctuate depending on market conditions, but generally a trader will earn between $50,000 and $150,000 per year, gross. This means a company employing 5 traders can expect to gross up to $750,000 per year. However, very successful traders can earn much more.

A broker or market maker may earn between $500,000 and $10 million or more per year.

How can you make your business more profitable?

Create a platform that other traders want to use. This market is driven by low trading costs and fast execution service. These are the two areas you should spend most of your time improving. This business also has a reputation among some traders for shady broker practices. Being transparent with your customers and explaining your trading practices, avoiding slippage in your buy and sell orders, and not using markup to boost profits, are all things that will keep your customers coming back to you and thus increase long-term profits for your company.

Want a more guided approach? Access TRUiC’s free Small Business Startup Guide — a step-by-step course for turning your business idea into reality. Get started today!

STEP 2: Form a legal entity

Establishing a legal business entity such as an LLC or corporation protects you from being held personally liable if your currency trading business is sued.

Read our Guide to Form Your Own LLC

Have a Professional Service Form your LLC for You

Two such reliable services:

- Northwest ($29 + State Fees)

- LegalZoom ($249 + State Fees)

You can form an LLC yourself and pay only the minimal state LLC costs or hire one of the Best LLC Services for a small, additional fee.

Recommended: You will need to elect a registered agent for your LLC. LLC formation packages usually include a free year of registered agent services. You can choose to hire a registered agent or act as your own.

STEP 3: Register for taxes

You will need to register for a variety of state and federal taxes before you can open for business.

In order to register for taxes you will need to apply for an EIN. It’s really easy and free!

You can acquire your EIN through the IRS website. If you would like to learn more about EINs, read our article, What is an EIN?

There are specific state taxes that might apply to your business. Learn more about state sales tax and franchise taxes in our state sales tax guides.

STEP 4: Open a business bank account & credit card

Using dedicated business banking and credit accounts is essential for personal asset protection.

When your personal and business accounts are mixed, your personal assets (your home, car, and other valuables) are at risk in the event your business is sued. In business law, this is referred to as piercing your corporate veil.

Open a business bank account

Besides being a requirement when applying for business loans, opening a business bank account:

- Separates your personal assets from your company’s assets, which is necessary for personal asset protection.

- Makes accounting and tax filing easier.

Recommended: Read our Best Banks for Small Business review to find the best national bank or credit union.

Get a business credit card

- Separate personal and business expenses by putting your business’ expenses all in one place.

- Build your company’s credit history, which can be useful to raise money later on.

Recommended: Apply for an easy approval business credit card from BILL and build your business credit quickly.

STEP 5: Set up business accounting

Recording your various expenses and sources of income is critical to understanding the financial performance of your business. Keeping accurate and detailed accounts also greatly simplifies your annual tax filing.

Make LLC accounting easy with our LLC Expenses Cheat Sheet.

STEP 6: Obtain necessary permits and licenses

Failure to acquire necessary permits and licenses can result in hefty fines, or even cause your business to be shut down.

State & Local Business Licensing Requirements

Certain state permits and licenses may be needed to operate a forex trading business. Learn more about licensing requirements in your state by visiting SBA’s reference to state licenses and permits .

Most businesses are required to collect sales tax on the goods or services they provide. To learn more about how sales tax will affect your business, read our article, Sales Tax for Small Businesses.

Services Contract

FOREX trading businesses should require clients to sign a services agreement before starting a new project. This agreement should clarify client expectations and minimize risk of legal disputes by setting out payment terms and conditions, service level expectations, and intellectual property ownership.

Informed Consent Agreement

It is recommended to provide clients with informed consent agreements to decrease legal liability and encourage transparency.

STEP 7: Get business insurance

Just as with licenses and permits, your business needs insurance in order to operate safely and lawfully. Business Insurance protects your company’s financial wellbeing in the event of a covered loss.

There are several types of insurance policies created for different types of businesses with different risks. If you’re unsure of the types of risks that your business may face, begin with General Liability Insurance. This is the most common coverage that small businesses need, so it’s a great place to start for your business.

Another notable insurance policy that many businesses need is Workers’ Compensation Insurance. If your business will have employees, it’s a good chance that your state will require you to carry Workers’ Compensation Coverage.

FInd out what types of insurance your Currency Trading Business needs and how much it will cost you by reading our guide Business Insurance for Currency Trading Business.

STEP 8: Define your brand

Your brand is what your company stands for, as well as how your business is perceived by the public. A strong brand will help your business stand out from competitors.

If you aren’t feeling confident about designing your small business logo, then check out our Design Guides for Beginners, we’ll give you helpful tips and advice for creating the best unique logo for your business.

Recommended: Get a logo using Truic’s free logo Generator no email or sign up required, or use a Premium Logo Maker.

If you already have a logo, you can also add it to a QR code with our Free QR Code Generator. Choose from 13 QR code types to create a code for your business cards and publications, or to help spread awareness for your new website.

How to promote & market a currency trading business

If you are promoting your services to other brokers, the best way to advertise is through FOREX forums, newsletters, and alternative investing websites and newsletters. You can also buy pay-per-click advertisements and run solo ads. The important thing to remember is FOREX and currency trading is an alternative investment for many people. So, advertise in places where your target market is likely to be hanging out.

How to keep customers coming back

Attracting and keeping customers is simple. This is a very competitive industry, so keep your spreads lower than your competition. Constantly check market rate spreads as they change periodically.

STEP 9: Create your business website

After defining your brand and creating your logo the next step is to create a website for your business.

While creating a website is an essential step, some may fear that it’s out of their reach because they don’t have any website-building experience. While this may have been a reasonable fear back in 2015, web technology has seen huge advancements in the past few years that makes the lives of small business owners much simpler.

Here are the main reasons why you shouldn’t delay building your website:

- All legitimate businesses have websites — full stop. The size or industry of your business does not matter when it comes to getting your business online.

- Social media accounts like Facebook pages or LinkedIn business profiles are not a replacement for a business website that you own.

- Website builder tools like the GoDaddy Website Builder have made creating a basic website extremely simple. You don’t need to hire a web developer or designer to create a website that you can be proud of.

Recommended: Get started today using our recommended website builder or check out our review of the Best Website Builders.

Other popular website builders are: WordPress, WIX, Weebly, Squarespace, and Shopify.

STEP 10: Set up your business phone system

Getting a phone set up for your business is one of the best ways to help keep your personal life and business life separate and private. That’s not the only benefit; it also helps you make your business more automated, gives your business legitimacy, and makes it easier for potential customers to find and contact you.

There are many services available to entrepreneurs who want to set up a business phone system. We’ve reviewed the top companies and rated them based on price, features, and ease of use. Check out our review of the Best Business Phone Systems 2023 to find the best phone service for your small business.

Recommended Business Phone Service: Phone.com

Phone.com is our top choice for small business phone numbers because of all the features it offers for small businesses and it’s fair pricing.

Is this Business Right For You?

This business is ideal for individuals who love high-risk businesses. You must be willing to work long hours, be good with numbers, and be willing to learn about and understand various trading algorithms. You should also be passionate about world economies.

Want to know if you are cut out to be an entrepreneur?

Take our Entrepreneurship Quiz to find out!

What happens during a typical day at a currency trading business?

A currency trading business starts early. Traders start trading currencies as soon as a market opens. The FOREX market technically does not close, since it is global. However, markets in one part of the world do close. It’s just that, when they do, another market opens for business. So, currency trading companies can theoretically work 24/7.

The day starts with a basic analysis of the markets, which includes current news stories, trends in the market, and an analysis of the company’s own capital and trading positions. Any open positions are checked and any closed positions are accounted for.

The company’s trading managers and representatives set their initial buy-in prices and stop-losses. They also check and monitor their margin or leverage. Leverage is often used in currency trading because currency price fluctuations are generally small. Leverage of 50:1 or 100:1 is not uncommon. This means a trader can control or trade $100 for every $1 of the company’s own capital.

What are some skills and experiences that will help you build a successful currency trading business?

You will need at least amateur-level knowledge of the currency markets. Working under a successful currency trader helps, but is not mandatory. There are no laws governing who can and cannot trade in the FOREX markets for business purposes. You will need proper licensing, however, if you want to become a broker or market-maker. You will also need cash reserves and a bond to guaranty your customers’ funds.

What is the growth potential for a currency trading business?

Growth potential is unlimited. A currency trading company can be as small as one person or it can grow into a broker or market-maker, offering trading services to other people.

TRUiC’s YouTube Channel

For fun informative videos about starting a business visit the TRUiC YouTube Channel or subscribe to view later.

Take the Next Step

Find a business mentor

One of the greatest resources an entrepreneur can have is quality mentorship. As you start planning your business, connect with a free business resource near you to get the help you need.

Having a support network in place to turn to during tough times is a major factor of success for new business owners.

Learn from other business owners

Want to learn more about starting a business from entrepreneurs themselves? Visit Startup Savant’s startup founder series to gain entrepreneurial insights, lessons, and advice from founders themselves.

Resources to Help Women in Business

There are many resources out there specifically for women entrepreneurs. We’ve gathered necessary and useful information to help you succeed both professionally and personally:

If you’re a woman looking for some guidance in entrepreneurship, check out this great new series Women in Business created by the women of our partner Startup Savant.

What are some insider tips for jump starting a currency trading business?

Start with small lot sizes and keep sufficient cash reserves. Most traders only trade with 5%-10% of their total tradeable capital. They employ leverage to make significant gains.

How and when to build a team

Build a team only if you want to become a broker or market-maker in the industry. You will need a small team of professionals who are also skilled in currency trading, customer service, and web design. You should build out your team when you have enough money to do so. Most currency trading companies start small, as professional traders. Consider doing the same.

A Beginner’s Guide to Forex for Business

International businesses have a distinct challenge that many other organizations don’t — foreign exchange.

When you do business with countries that use a different currency than you, there are a few things you have to keep in mind.

First, you will be subject to movements in the values of currencies.

Depending on how they move, your collections could be worth less (and your payments, more), from one day to another.

Another challenge with foreign exchange is complicated terminology.

Forwards, futures, spots… what does it all mean?

Before you dive into the world of forex, you need to be well-prepared in the way it works.

By defining terms, examining history, and looking at the way the market works, you can gain a competitive edge in forex that can save you a lot of money.

What is Forex?

Forex, or foreign exchange, is the single largest market in the entire world.

Over $5 trillion (yes, that’s trillion with a “T”) change hands every single day.

The reason for this astronomical volume comes down to the frequency with which individuals and businesses use the forex market.

It starts at the consumer level — when people want to visit another country, they must trade in some of their homeland’s currency for the currency of the country they are visiting.

This is a forex transaction.

Banks trade forex as well. In fact, financial institutions have their hand in over 90% of all forex transactions.

Banks trade money with consumers as well as other banks several thousand times a day, either to meet client needs or make a profit.

Another classification of forex traders is retail traders or speculators.

These are people who seek to earn a profit by buying one form of currency when it is priced low, and then selling it when it gains value.

The final player in the forex market is international businesses (that’s you!).

Businesses often need to exchange money in order to pay international suppliers.

Or, they need to convert the money they received from a foreign buyer into their native currency.

Regardless of your reasoning for participating in forex, there are a few basic things you should know before going forward.

History of Forex

Foreign exchange has existed for longer than recorded history.

As soon as there was more than one type of money in the world, people started trading it.

Money is a natural formation in human culture.

Let’s say you are a grain farmer, and you have a large amount of grain from your last harvest that you need to trade away.

In town, you find a pig farmer who has pork that he needs to trade away.

You happen to want some pork, so you want to trade with the man.

Now, you can’t just trade all your grain for all of his pork, because then you’ll have way too much pork (and, conversely, he’ll have way too much grain.)

You have to get rid of all of your grain soon, otherwise, it’ll get moldy, and the harvest will be a waste.

You need an efficient way to store your wealth.

You decide to visit the town’s copper miner. He needs a ton of grain to feed his laborers, so you give him all of your grain in exchange for an amount of copper of equal value.

You can hold on to this copper forever since it won’t go bad or lose value.

You visit the pig farmer, buy enough pork to feed your family, and give him only a small amount of your copper.

The pig farmer can now use this copper for his own similar dealings.

Thus, money is formed naturally in a free market scenario.

While your local town turns to using copper as their money, a nearby town has been using emeralds.

As time goes on, and these currencies are formalized, you need a way to change your copper into emeralds for use at the other town’s market.

You decide to set up a brokerage to change people’s copper into emeralds, and vice versa, for a small fee.

Thus, this foreign exchange also forms naturally in a free market.

The first true modern foreign currency exchange was established in Amsterdam in the 1600s, where traders would exchange money through a broker before visiting another nation’s market. It’s believed that this forex market was also used to combat inflation.

Forex exchanges remained pretty much the same for a few centuries.

In the 1990s, however, computerized trading began to take hold, allowing trades to occur instantly from thousands of miles away.

This computerized Forex trading eventually evolved into the hierarchy of the different types of traders that we see today.

Types of Forex Traders

Forex traders take a few different roles, activities, and risks, and never truly fall into a single trader persona.

Here are a few types of forex traders you should be aware of should you encounter them or seek certain trading styles.

Retail Traders/Speculators

The most common type of forex trader is an individual who trades for a profit with their own money.

Mind you, retail traders only account for a small amount of volume in the market, despite their large numbers.

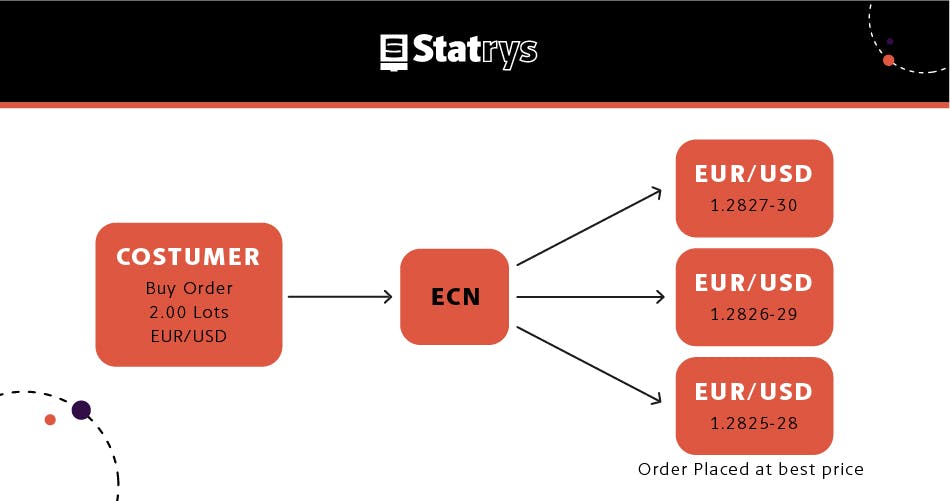

Retail trading brokerages come in two main forms: Market makers and Electronic Communications Networks (ECNs).

ECNs supply a far more “true” market than market makers.

ECNs work by bringing buyers and sellers together over the internet, matching retail traders with retail traders, retail traders with banks, and banks with banks.

An ECN allows forex transactions to occur with far less interference from “middleman” forces.

That brings us to market makers.

Market makers are very aptly named.

They make the market by taking the other side of whatever deal their clients want.

So if you shout “Hey! I want $1,000, and I’ll give you ¥100,000 for it!”, your market-making broker will tell you to check your account, because it’s already done.

There’s good news and bad news with this.

The good news is that you always have someone to take your deal.

This is embodied in the concept of liquidity (your ability to convert an asset into cash, or in this case, foreign currency into home currency.)

In ECN, you may need to wait for someone who wants to accept your deal.

The bad news is that market makers have a vested interest in making you lose money.

If you’re losing money on a trade, your market maker will make a profit.

If you’re winning the trade, they’ll pass their side of the trade to another client or to a bank in order to minimize their losses.

.jpg?ixlib=gatsbyFP&auto=compress%2Cformat&fit=max)

80% to 90% of retail traders lose money in the forex market.

This is because the forex market is a zero-sum game — for every winner, there must be an equivalent loser.

Banks and business are, by a very wide margin, the winners in the forex market.

Banks as Forex Participants

Banks use the forex market for many, many reasons.

They use the forex market to allow their clients to use debit cards overseas.

Before going on an international vacation, a bank account user will notify their bank about where they’re going and when.

This prepares the bank for the foreign exchange needs of the client (it also prevents their card from being automatically frozen in anti-theft measures).

Banks also use forex to provide hedging services to their trading branches, as well as their business clients.

There are a number of instruments used for this, which will be covered later.

International Businesses

One of the largest sources of volume in the forex is international business owners just like you.

International businesses have several hands in the forex market, all relating to their different business processes.

The simplest and most common international business forex transaction is a simple currency conversion.

When you receive money from an international buyer, you will be left with a large sum of their currency.

Since you can’t spend this in your country (for marketing, equipment, etc.), you must convert it to your own currency.

Conversely, when paying an international supplier, you often have to convert your currency into their currency first.

Businesses and banks also use forex to hedge their positions and prices against fluctuations in currency prices.

There are three main ways to do this.

Spot Contracts Vs. Forward Contracts

This act of converting currency at the current (or “spot”) market rate can be formalized in a forex spot contract.

In a forex spot contract, two parties agree to exchange their currencies at a predetermined settlement date.

That can be today or years from now. When you exchange currency at the market rate, you are essentially trading within a spot contract.

Another type of forex contract is called a forex forward contract.

In a forward contract, two parties agree to change the currency at a predetermined date, and at a predetermined exchange rate.

Let’s walk through an example.

You own an international business. You know you’ll be receiving payment in yen three months from now.

However, you want to limit your exposure to changes in the price of yen.

You’re worried that, in three months, the yen will not be worth as much as it is now.

This is a classic example of where a forex forward contract can help you protect your business and limit your exposure to fluctuations in the market.

To hedge in this situation, you would simply enter a forex forward contract (with a bank or other financial institution), agreeing to convert the yen to your home currency at today’s rate in three months.

Bear in mind that if the value of a yen increases during those three months, you will effectively have missed out on potential forex gains.

This potential opportunity cost is part of the price you pay for the stability of your payment’s value.

Forex Futures Contracts

Forex futures contracts are almost exactly the same as forwarding contracts, with one notable exception.

While forward contracts are negotiated only between the two parties, futures contracts are managed on an exchange.

This means that futures are far more standardized and pass through a clearinghouse.

Generally, futures contracts are safer than forwarding contracts, since the payment is guaranteed from and to each party.

Forward contracts are very safe as well (especially when they’re constructed with a dedicated financial services company), even though they are technically vulnerable to default.

A futures contract is a great way to hedge as well, although they lack the customization and freedom of a forward contract.

Why Currencies Fluctuate In Value

The way currencies fluctuate in value is determined by a number of factors.

One of them is the type of currency and how it reacts to changes in the prices of other currencies.

The first distinction to be made is between fiat and commodity currencies.

Historically, money was usually printed on a commodity (gold and silver coins, for example.)

This form of money is practical in that the physical monetary item has some intrinsic worth.

It also means that the supply of money in a given economy cannot be easily manipulated.

.jpg?ixlib=gatsbyFP&auto=compress%2Cformat&fit=max)

Often, a country will make its monetary system more practical by having a given amount of commodity, and then issuing paper money that is backed by that commodity.

An example of this is the Gold Standard, where every U.S. dollar was backed by a fixed amount of gold.

A fiat currency, by contrast, is a currency that has no intrinsic value and is not backed by any real commodity.

The value of these currencies is determined by the money supply, which can be manipulated by changing interbank borrowing rates or printing more money.

This helps to combat things like inflation or deflation, but can also prove to be unsustainable in the long run with central bank abuse.

Almost every modern currency is a fiat currency.

Currencies fluctuate in value because they are subject to the whims of their central banks.

Depending on new policies and money supply, the value of a currency can change.

Currencies also fluctuate based on the natural laws of supply and demand.

If everyone wants yen, the yen will increase in value.

If Yen is not an appealing investment, or if no one needs them, they will decrease in value.

Demand is dedicated to the economic status of a given country, as well as events like news and economic reports.

To keep up with turnover and fluctuations in the Forex market, reports are generated periodically that help better reveals the exact turnover for harder currencies where trades have more impact on the global economy. Here’s an example.

Forex with Statrys

Foreign exchange is a very broad term. It covers everything from changing your cash for a vacation to complicated and mysterious financial derivatives that make even the most experienced financier shiver.

Statrys operates several different forex-related services that can empower your business in the international realm.

We help our clients navigate the jungle of forex so they can use these tools to their advantage, rather than their detriment.

Start by checking out our comprehensive forex guide below — we walk through everything you need to know before you get started.

Then, check out our forex services to see what’s right for your business.

https://howtostartanllc.com/business-ideas/currency-trading