Best forex trading strategies and techniques

We all know that forex trading can be tricky to begin, but finding the right forex strategies to trade with is the key for beginner traders entering the forex market.

The forex market is the largest and most liquid financial market in the world. With an average daily trading volume of $6.6 trillion, more than double that of the New York Stock Exchange, making it an attractive arena for traders.

Trading currencies can be a rewarding endeavor for those who are willing to take on the risk. However, there are many pitfalls that beginners should avoid if they want to succeed long term.

That means finding the right trading style!

Continue reading to discover forex trading strategies that work and gain some insights into what you need to do as a beginner trader to be successful in the forex market. But first, understand exactly what a forex trading strategy is and how to choose the right one for you.

What is a forex trading strategy?

A trading strategy could be described as a set of rules that help a trader determine when to enter a trade, how to manage it, and when to close it. A trading strategy can be very simple or very complex — it varies from trader to trader.

Traders using technical analysis will find it easier to define their entry/exit rules, while traders utilising fundamental analysis might find it a bit more difficult as more discretion is involved. Regardless of that, every trader should have a strategy prepared, as this is the best way to achieve consistency and help you measure your performance accurately.

How to choose the best forex strategy?

Very few traders find the right forex strategy straight away. The majority will spend a significant amount of time testing various strategies with a demo trading account and/or backtesting. This allows you to conduct your tests in a safe and risk-free environment.

Even if a trader gets to the point where they find a strategy that has promising results and feels right, it is unlikely that they will stick with that exact strategy for an extended period of time. The financial markets are evolving constantly, and traders must evolve with them.

If you are a beginner, sticking with simple strategies might be preferable. Many beginners make the mistake of trying to incorporate too many technical indicators into their strategy, which leads to information overload and conflicting signals. You can always tweak your strategy as you go and use the experience you learned from backtesting and demo trading.

Most commonly used forex trading strategies for beginners

See our list of 12 effective forex trading strategies for beginners below:

- Price action trading

- Range trading strategy

- Trend trading strategy

- Position trading

- Day trading strategy

- Scalping strategy

- Swing trading

- Carry trade strategy

- Breakout strategy

- News trading

- Retracement trading

- Grid trading

1. Price action trading

Price action trading is a strategy that focuses on making decisions based on the price movements of a certain instrument instead of incorporating technical indicators (e.g. RSI , MACD, Bollinger Bands). There is a variety of price action strategies you could utilise — from breakouts and reversals to simple and advanced candlestick patterns .

Technical indicators generally are not part of a price action strategy, but if they are incorporated they should not play a large role in it but rather be used as a supporting tool. Some traders like to incorporate simple indicators such as moving averages as they can help identify the trend.

The benefits of price action trading are that your charts remain clean, and there is less risk of suffering from information overload. Having multiple indicators on your chart can send conflicting signals, which can lead to confusion, especially for beginners.

Reading the price action can also give you a better feeling for the market and help you identify patterns more efficiently. Another reason price action trading is especially popular amongst day traders is that it is more suitable for traders looking to profit from short-term movements. With day trading, you need to make decisions quickly, and having a «clean chart» and focusing purely on the price action will make this process easier.

Below is an example of a simple breakout trading strategy. 1.1772 was an important support level and our trader was waiting for a breakout to occur, so they could short EUR/USD to profit from the next leg lower. We can see that the overall trend is in their favour (downtrend). A breakout did occur and the currency pair fell more than 70 pips before eventually finding support at 1.1700.

Some traders prefer to enter as soon as the price breaks below the key support level (perhaps even with a sell-stop order), while other traders will wait to monitor the price action and take action later. False breakouts do occur frequently, so it is important to have appropriate risk management rules in place to deal with those.

2. Range trading strategy

Traders utilising a range trading strategy will look for trading instruments that are consolidating in a certain range. Depending on the timeframe you are trading on, this range could be anything from 20 pips to several hundred pips. What the trader is looking for is consistent support and resistance areas that are holding — i.e. price bouncing off the support area and the price being rejected at the resistance area.

Traders using this strategy must look for trading instruments that are not trending. To do so, you may simply look at the price action of the instrument, or use indicators such as the moving average and the average direction index (ADX). The lower the ADX value, the weaker the trend.

After you have found a suitable trading instrument, you must identify the range that the trading instrument is consolidating within.

A classic range trading strategy will tell you to sell when the price hits the area of key resistance and buy when the price hits the area of key support. Some traders will focus on two particular levels, while others will trade «bands» or «areas» — for example, if you identified 1.17 as the key resistance level but the price often stalls at 1.1690 or 1.1695, you can highlight that area (1.1690 — 1.17) and start looking for selling opportunities within it. Only focusing on that particular level might mean you will lose out on good trading opportunities, as prices can often reverse before hitting it.

Below is an example of a currency pair that is range trading (EUR/SEK). The ADX has low readings most of the time, and we can see that the price has often bounced off the 10.00/04 support area while having difficulties breaching the resistance area between 10.27 and 10.30.

3. Trend trading strategy

Trend trading strategies involve identifying trade opportunities in the direction of the trend. The idea behind it is that the trading instrument will continue to move in the same direction as it is currently trending (up or down).

When prices are consistently rising (posting higher highs), we are talking about an uptrend. Vice-versa, declining prices (the trading instrument is making lower lows) will indicate a downtrend.

Except when looking at the price action, traders can use supporting tools to identify the trend. Moving averages are one of the most popular ones. Traders might simply look at whether the price is trading above or below a moving average (the 200 DMA is a popular and widely watched one) or use MA crossovers.

To use moving average crossovers (which can also be used as entry signals), you will have to set a fast MA and a slow MA. One popular example is the 50 DMA and the 200 DMA. The 50-day moving average crossing above the 200-day moving average could indicate the beginning of an uptrend, and vice-versa.

Below is an example with the USD/JPY and two DMA crossovers (50 DMA & 200 DMA).

4. Position trading

The goal of position trading is to capture profits from long-term trend moves while ignoring the short-term noise occurring day to day. Traders that utilise this type of trading style might hold positions open for weeks, months, and in rare cases – even years.

Along with scalping, it is one of the more difficult trading styles. It requires a trader to remain highly disciplined, able to ignore the noise, and remain calm even when a position moves against them for several hundred pips.

Imagine for example, that you had a bearish outlook on stocks in early 2018. You shorted the S&P 500 at the beginning of the year, with the intention of keeping the position open for the rest of the year. While you would have enjoyed the price movements at the beginning and the end of the year, the rally from March to September could have been a painful experience. Only a few traders have the discipline to keep their positions running for such a long time period.

5. Day trading strategy

Day traders usually do not hold trades only for seconds, as scalpers do. However, their trading day also tends to be focused on a specific session or time of the day, when they try to act on opportunities. While scalpers might use an M1 chart to trade, day traders tend to use anything from the M15 up to the H1 chart.

Scalpers tend to open more than 10 trades per day (some highly active traders might end up with even more than 100 per day), while day traders usually take it a bit slower and try to find 2-3 good opportunities per day.

Day trading could suit you well if you like to close your positions before the trading day ends but do not want to have the high level of pressure that comes with scalping.

6. Scalping strategy

When scalping, traders are trying to take advantage of small intraday price moves. Some even have a target of only 5 pips per trade, and the trade duration could vary from seconds to a few minutes. Scalpers need to be good with numbers and be able to make decisions quickly, even when under pressure. They also usually spend more time in front of the screen and tend to focus on one or a few specific markets (e.g. only scalping EUR/USD or only S&P 500 futures).

The advantage of being a scalper is that it allows you to focus on the market in a specific timeframe, and you do not have to worry about holding your positions overnight or interpreting long-term fundamentals.

However, scalping comes with a lot of pressure as you need to be fully focused during your trading session. Furthermore, it is easier to make mistakes and react emotionally when your trades are running only for minutes. It may therefore not be the best trading style for beginners to start with.

7. Swing trading

Swing trading is a term used for traders who tend to hold their positions open for multiple days. They might use anything from a H1 to a D1 chart, or even weekly. Popular trading strategies include trend following, range trading, or breakout trading.

Traders who choose this type of trading style need patience and discipline. It might take days for a quality opportunity to show up, or you might end up holding a trade open for a week or more while running an open loss. Some traders do not have the necessary patience and close their trades too early.

If you like to analyse the markets without any rush and are comfortable with running positions for days or even weeks – swing trading might be the right trading style for you. It also gives you the opportunity to include fundamental analysis (trying to anticipate monetary policy moves or political developments) – which is futile to do when scalp trading.

8. Carry trade strategy

A trader using a carry trade strategy will try to profit from the difference in interest between the two different currencies that make up a currency pair.

A trader would go buy a currency with a high-interest rate and sell a currency with a low interest rate. A popular example is going long AUD/JPY (due to Australia´s historically high and Japan´s historically low interest rates). By doing so, the trader will receive an interest rate payment based on the size of their position.

The benefit of a carry trade strategy is that you can earn a substantial interest from just holding a position. Of course, you need the right market environment for this to work. If AUD/JPY is in a strong downtrend and you are holding a long position, the interest payments will not make up for the overall negative PnL.

Carry trades perform well in a bullish market environment when traders are seeking high risk. The Japanese Yen is a traditional safe haven, which is why many carry trades involve being short on the Yen against another «risk-on» currency .

However, you should also be familiar with the characteristics of the currency you are buying. For example, the Australian Dollar will benefit from rising commodity prices, the Canadian Dollar has a positive correlation with oil prices, and so on.

Below is a chart of the AUD/JPY and highlighted is a period when the currency pair was performing extremely well, and a carry trade would certainly have made sense.

9. Breakout strategy

A breakout strategy aims to enter a trade as soon as the price manages to break out of its range. Traders are looking for strong momentum and the actual breakout is the signal to enter the position and profit from the market movement that follows.

Traders may enter the positions in the market, which means they will have to closely monitor the price action, or by placing buy-stop and sell-stop orders. They will usually place the stop just below the former resistance level or above the former support level. To set their exit targets , traders may use classic support/resistance levels.

10. News trading

News trading is a strategy in which the trader tries to profit from a market move that has been triggered by a major news event. This could be anything from a central bank meeting and an economic data release to an unexpected event (natural disaster or geopolitical tensions escalating).

News trading can be very risky as the market tends to be extremely volatile during those times. You will also find that the spread of the affected trading instruments may widen significantly. Due to liquidity evaporating, you are also at risk of slippage — meaning your trade could be executed at a significantly worse price than expected or you may struggle to get out of your trade at the level you had in mind.

So now that you are aware of the risks, let’s look at how you could trade the news.

First of all, you need to determine which event you want to trade and which currency pair(s) it will affect the most. A meeting of the European Central Bank will certainly impact the Euro the most. However, which specific currency pair should you pick? If you are expecting a hawkish ECB that will signal rate hikes, it would make sense to pick a low-yielding currency, such as the Japanese Yen. EUR/JPY could therefore be the right choice.

Furthermore, you can approach news trading either with a bias or no bias at all. It means that you have an idea of where you think the market might move depending on how the event unfolds. On the other hand, news trading without bias means that you will try to capture the big move regardless of its direction.

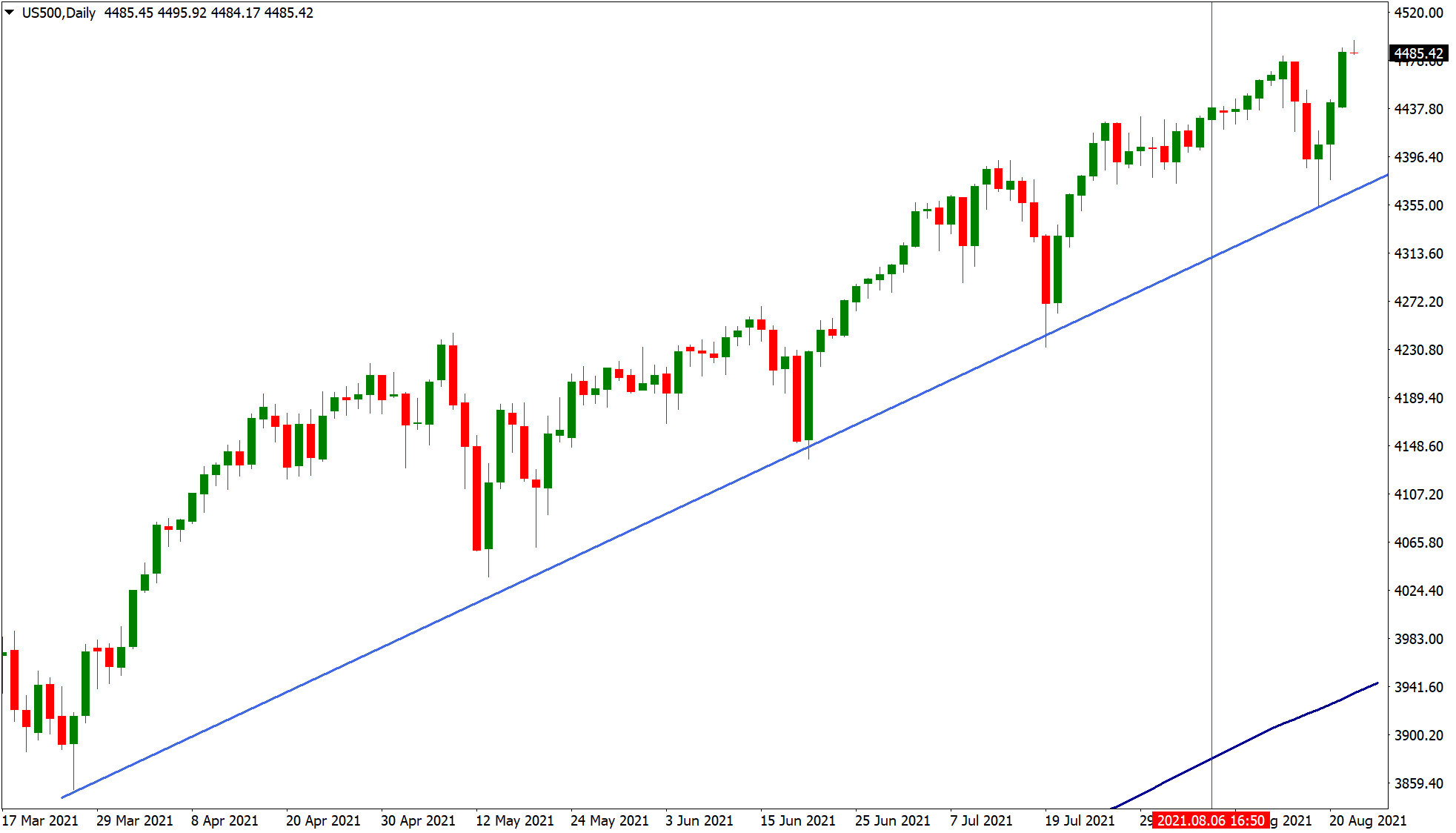

Below is an example of the impact the July NFP release had on the US500.

11. Retracement trading

Retracement trading includes temporary changes in the direction of a certain trading instrument. Retracements should not be confused with reversals — while reversals indicate a major change in the trend, retracements are just temporary pullbacks. By trading retracements, you are still trading in the direction of the trend. You are trying to capitalise on short-term price reversals within a major price trend.

There are several ways you can trade retracements. For example, you could use trendlines. Let’s have a look at the chart of the US500 below. The index is in a clear uptrend and the rising trendline could have been used as a buying opportunity (once the price tests the actual trendline).

Fibonacci retracements are another popular tool to trade retracements — particularly the 38.2 %, 61.8 %, and 78.6 % levels.

12. Grid trading

Grid trading involves placing multiple orders above and below a certain price. The idea behind it is to profit from volatility by placing both buy and sell orders at regular intervals above and below the set price level (for example, every 10 pips above and below).

If the price moves in one direction, your position gets larger and so does your floating PnL. The risk is of course, that you will get false breakouts or a sudden reversal.

How to compare forex strategies?

Each trader should try to identify their own edge. This might be a set of skills that the trader possesses.

For example, some traders might have a short attention span but are quick with numbers and can handle the stress of intraday trading extremely well. Whereas a trader with a different trading style may not be able to function efficiently in this kind of environment, but could instead be a skilled strategist who can always keep sight of the bigger picture.

For beginner traders, it is especially important to identify what skills they may have and tailor the trading strategy according to each individual’s personality, not the other way around. There are many benefits of forex trading so it’s up to you to compare the strategies which may be better suited.

How can you find out which FX trading strategy suits you?

Test them out in a demo environment with virtual funds. When you get a feeling about which one suits you the best, you can consider testing it out in a live environment. Not even then is the process finished.

Some traders might find day trading suitable for them, but then change to swing trading later in their trading career. Just as the market environment constantly evolves, so do traders and their preferences.

In addition to that, you can take one of the many free personality tests on the internet, which might provide you with further insights.

Ready to trade your edge?

Join thousands of traders and trade CFDs on forex , shares , indices , commodities , and cryptocurrencies !

This information is not to be construed as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product, or instrument; or to participate in any trading strategy. It has been prepared without taking your objectives, financial situation, or needs into account. Any references to past performance and forecasts are not reliable indicators of future results. Axi makes no representation and assumes no liability regarding the accuracy and completeness of the content in this publication. Readers should seek their own advice.

Milan Cutkovic has over eight years of experience in trading and market analysis across forex, indices, commodities, and stocks. He was one of the first traders accepted into the Axi Select programme which identifies highly talented traders and assists them with professional development.

As well as being a trader, Milan writes daily analysis for the Axi community, using his extensive knowledge of financial markets to provide unique insights and commentary. He is passionate about helping others become more successful in their trading and shares his skills by contributing to comprehensive trading eBooks and regularly publishing educational articles on the Axi blog, His work is frequently quoted in leading international newspapers and media portals.

Milan is frequently quoted and mentioned in many financial publications, including Yahoo Finance, Business Insider, Barrons, CNN, Reuters, New York Post, and MarketWatch.

Find him on: LinkedIn

Forex Trading Strategies

Use forex trading strategies that work, and you’ll enter (and exit) the markets with a bang.

Tim Fries

Tim Fries is the cofounder of The Tokenist. He has a B. Sc. in Mechanical Engineering from the University of Michigan, and an MBA from the University .

Reviewed by

Shane Neagle

Shane Neagle

Meet Shane. Shane first starting working with The Tokenist in September of 2018 — and has happily stuck around ever since. Originally from Maine, .

Updated March 07, 2024

All reviews, research, news and assessments of any kind on The Tokenist are compiled using a strict editorial review process by our editorial team. Neither our writers nor our editors receive direct compensation of any kind to publish information on tokenist.com. Our company, Tokenist Media LLC, is community supported and may receive a small commission when you purchase products or services through links on our website. Click here for a full list of our partners and an in-depth explanation on how we get paid.

The year 2020 was a roller coaster—so much so that the trends set in forex then have not really stopped to this day.

When the COVID-19 fallout began in March 2020, forex trading volume increased by 300% in the following months. Today, this is a market where around $6.5 trillion is traded globally every day—and everyone wants a piece of that ludicrously gigantic pie.

Millions have entered the market this year just in the U.S., and brokers are competing for their trust (and money). This competition has made the present moment a perfect time to start trading quickly and cheaper than ever. Seriously—most brokerages will give you a trading platform for $0.

If you have fire in your heart and want to make money for forex, that’s the most important thing. However, it’s also crucial to have a good strategy because not having one is like throwing your money into a well and waiting for those profits to start rolling in (they won’t).

To make choosing a strategy easy, we’ve made a list of the most popular trading tactics and separated them by how much time they take to implement and how risky they are. Some are very beginner-friendly and can make you your first profits today, while some take more time to master but will bring pure joy (and material gain) once you figure them out. Let’s check out a few forex strategies that work, and see which one is perfect for you.

What you’ll learn

- What is Forex?

- Forex Trading Strategies Explained

- Popular Forex Trading Strategies

- Start Trading Forex in 4 Steps

- What You Have to Know Before Trading

- Risks of Trading Forex

What Is Forex?

Forex stands for “Foreign Exchange” and it is a global currency marketplace. Traders from all over the world can buy and sell currencies here through their computers and make profits day in and day out by anticipating what’s going to happen in the markets.

The key to being a successful trader is knowing how to predict whether prices are going up or down. Knowing how to trade forex includes understanding charts, analyzing them, and paying attention to important global events—although, if you want to specialize in one area, you don’t have to know everything.

If you have the necessary knowledge, then you only need a starting capital as well as a good forex broker to invest through. When all of that is taken care of, the last piece of the puzzle is choosing a strategy that works—let’s see why this is so important.

What Are Forex Trading Strategies (and Why You Need One) ️

You can approach the stock market without a particular strategy and just buy popular stocks and funds—likely, you’ll make a lot of money in the long run and everything will be ok. However, forex is not like that.

Exchanging currencies is all about noticing small opportunities and exploiting them quickly. Making these predictions is a pretty common and straightforward process—and it’s usually based on simple maths.

Don’t worry, you don’t have to be a mathematician—most forms of forex trading are relatively easy to get used to and that’s where trading strategies come in. Mastering a simple strategy will allow you to make correct predictions and profit most of the time unless a black swan event like COVID-19 happens.

But even then, if you can adapt quickly, you will make an even greater profit. Randomness and chaos affect all traders, and the more confused they are, the more opportunity you have to strike gold.

One more huge benefit of knowing about strategies is that all traders use them. If you know how these tactics work, you know what the forex people of the world are thinking—this way, you will know what they’re going to do in advance and you will be prepared.

Are you in the US? Take a look at our report on the leading forex brokers in the US.

What Are the Best Forex Trading Strategies?

The best strategies are those that work, have always worked, and will continue to work in the foreseeable future. We will now list and explain these strategies and rate how beginner-friendly, time consuming, and risky each one is. Hopefully, you’ll be inspired by one or two and may even start making profits soon. Let’s see what these are:

- Range Trading

- Trend Trading

- Position Trading

- Day Trading

- Forex Scalping

- Swing Trading

- Carry Trade

- The 50 Pips a Day Strategy

1. Range Trading ↕️

This strategy consists of looking at a price chart and finding the so-called resistance and support lines. You can make a resistance line by looking at the highest price points over a certain period and connecting them with a straight line.

Thus, the resistance line will represent the highest usual price—everything that goes beyond it is a bubble and it means you should sell as you won’t get a better price anytime soon. You can think of a resistance line as an upper price limit of a currency pair—if the price goes beyond it, that means that traders have overbought and that the price will drop very soon.

The support line is just the exact opposite of the resistance line. You just take all the points on the chart where the price dipped and draw a straight line through them. If the price goes below this line, it means that traders have oversold and that it’s prime time to buy your currencies while they’re cheap.

As you can see from the bottom part of this graph, the blue boxes represent peak prices and the red ones represent bottom prices. Once you find the usual top and bottom points, draw lines through them and treat everything that falls outside your two lines as a perfect buying/selling opportunity.

This tactic only works if the markets are stable and passive. If the prices are going up or down, you need a different approach, and if the prices are too volatile, using range trading might prove impossible.

Other than that, it’s one of the more simple approaches to forex but requires a substantial amount of time from the trader. Nonetheless, this strategy is recommended for complete beginners who are just getting introduced to forex trading.

Pros

- Works best in a low-volatility market

- Good strategy when the price is in relative stagnation (it’s not going up or down)

- Safe, beginner-friendly strategy that requires minimal research tools

Cons

- Relatively time-consuming

- Not the most profitable approach

- Research is necessary

2. Trend Trading

Unlike range trading, this strategy uses price trends to find buying and selling opportunities. Here you must also find the lowest lows in the price chart and the highest highs. Then you should draw lines through them and that will represent the price trend—this can either be an upward or downward trend.

As you can see on this chart, the red circles mark the dips in the price of the EUR/USD pair, and the blue circles represent the high points. So, if the highs are steadily getting higher and the lows are steadily getting higher, this is an upward trend.

That tells you you should buy the currency pair when it dips and sell when the price surpasses the latest high point—or you can hold it for a while and sell when the price grows a lot. Naturally, the approach is the opposite if you have a downward trend on your hands.

In summary, you have a checklist that looks like this:

- Are the highs getting higher over time on average?

- Are the lows getting higher over time too?

- Is there no news about something that will reverse this trend?

If the answer to all these is yes, you usually have a steady upward trend on your hands and you can exploit it. However, never get too excited with forex—no one can truly predict what’s going to happen in the markets, so it’s best to play it safe.

Pros

- Very approachable for new traders

- Good risk-reward ratio

- There is always an abundance of trading opportunities

Cons

- Slightly higher-risk and less beginner-friendly than range trading

- Studying trends is time-consuming and must be done very thoroughly

3. Position Trading

This is a long-term strategy that requires fundamental analysis but also following macroeconomic trends and relevant news. The idea is to pinpoint the so-called “head and shoulders” price points over a long period and use them to learn whether prices are going to move up or down in the foreseeable future.

As you can see in the graph above, the places where the prices stay very high for a long time are the head and shoulders points. Finding these areas and drawing a line through them can tell you where the prices are going. Short-term price fluctuations are not considered here—it’s just about figuring out the big picture.

For this strategy to work, you need to look at price charts over a long period—months, or even years—and hold your position for a long time if it’s an upward trend (or short the position if the prices are going down). This is a patient trader’s game and you can use this tactic for forex as well as stocks.

In this example, we can see the Germany 30 index. An important thing to note is the effect that Brexit had on the movement of the price trend—you need to analyze charts and follow the news just so you can take major economic events into your calculations.

Are you a trader on the go? Check out the top forex trading apps for mobile access to the forex market.

Pros

- Very little time is required

- Good for long-term traders

- Very favorable risk-reward ratio

- Works on the stock market too

Cons

- Requires more thorough research over a longer period

- Global economic events can impact your strategy massively

- Rare trading opportunities

4. Day Trading ⏲️

If you want to invest occasionally, day trading is not for you—but if you want to make forex your job, this can be the strategy you’ve been looking for. Day traders open and close all their positions during the same trading day—nothing is left to sit overnight.

This strategy is all about finding small daily price fluctuations, buying low, and selling high. Trades are executed in a matter of hours, if not minutes, and you usually cannot make high returns on any single one. However, a few trades every day will start to pile up if you do them right—and you will amass enough capital to make every trade count.

This chart shows all price dips throughout a single trading day. Ideally, you want to buy when the price is at its lowest and sell when it’s at its highest. As you can see, at the end of the trading day, the price usually goes down because all day traders want to sell their positions before it’s bedtime.

Upward trending financial instruments are always a good target for day traders. In this case, as long as you buy in the morning, you will be able to sell high in the afternoon—that’s a low-risk, OK-reward situation.

The product type you choose to trade will determine how risky this strategy is, but you’ll usually be dealing with small price changes, so your balance won’t suffer much if you make a bad trade. This makes leveraging your trades more viable as the risk-reward ratio is manageable.

Pros

- Favorable risk-reward ratio

- Abundant trading opportunities

Cons

- Day trading is a full-time job

- Requires strong technical analysis

5. Forex Scalping

For those who don’t know, scalping forex means making quick small trades and making a very small profit from each one. Scalpers open and close multiple positions each day either manually or with a trading algorithm that uses your guidelines to know when to buy/sell.

Scalping is as time-consuming and profitable as you want it to be. Individual trades are usually opened and closed within a few minutes but you can make as many of these as you want throughout the day.

First, you must identify a trend as you would when trend trading—make sure that the price highs are growing and that price lows are moving up as well. Then, you should buy the dip, hold as the upward movement has momentum, and sell as soon as prices reach the resistance line.

Pros

- Applicable to almost all financial instruments

Cons

- Many forex brokers don’t allow scalping and closing trades too quickly can get your account closed and your funds frozen

- Very low risk-reward ratio

- The most time-consuming out of all forex strategies

6. Swing Trading ️

This is a mid to short-term trading strategy that entails predicting price trends and buying/selling accordingly. This is similar to trend and range trading, but swing traders inspect price trends in a smaller time frame and close trades within a few hours or days.

Because swing trading is a short-term strategy, traders only need to focus on price analysis rather than long-term macroeconomic trends and important global developments. This makes swing trading simpler but also relatively risky since price changes are always more hectic on a day-to-day basis.

Identifying price trends by finding the “highs” and “lows” is key here. If both the high and low price points are moving up together, this means you have an upward trend on your hands and that you should enter a long position. If the opposite were true, shorting would be the way to go.

Pros

- Not very time-consuming

- Average risk-reward ratio

Cons

- Holding overnight positions carries risk

- Occasional trading opportunities

7. Carry Trade

This means borrowing one currency at a low rate and then investing in another currency that provides a higher rate. Doing this will produce a positive carry on the trade—hence the name.

The profitability of your trade will depend on two things—the difference in interest rates on the two currencies you’re exchanging, and the amount of your initial capital/borrowing power. This means that profits can be small but also substantial, it all depends.

Plus, there’s always risk involved. Since carry trades usually involve leverage, they have the potential to be very risky.

To make a good trade, you need to look at the fluctuations in interest rates over a medium to a long period (months or even years). Ideally, you should borrow a currency that has a low, declining interest rate and get a currency that has a high, increasing rate—that way your profits will be as good as they can be.

Pros

- Not time-consuming

- Average risk-reward ratio

- Very high profits are possible if you grab the right opportunity

Cons

- Good trading opportunities are rare

- Dependant on very specific upward trends

8. 50 Pips a Day

If you want a fresh and popular strategy with a clear daily financial goal—then the 50 pips a day forex strategy is it. At 7 a.m. GMT, after the candlestick closes, traders enter two opposite positions with pending orders. When one order gets triggered by a price movement, the other one gets canceled automatically. This way, there’s no way to lose.

Your goal is 50 pips and the stop-loss order is usually set somewhere between 5-10 pips—that’s under or above the 7 a.m. point. After you’ve set everything up, it’s time to relax and let price changes take care of the rest.

The orange box in the chart above represents the 7 a.m. candlestick point that is crucial for this strategy. Ideally, you want the bar after the candlestick where you placed your orders to be as high or as low as possible—but even if it isn’t, you can cancel your orders and manage risk that way.

Pros

- The least time-consuming strategy on this list

- Very low risk

Cons

- Profits are limited to 50 pips a day (what if the price changes by 300 pips?)

- Limited to one trade per day for each currency pair

- You need to watch both pending orders so you can cancel one in time when prices change

Start Trading Forex in 4 Steps

Getting into forex has never been easier—since the COVID-19 breakout, millions of new traders have stepped into the markets and global trading volumes have gone up by more than 25%.

Naturally, forex brokers have been competing to pick up as many of these newcomers, making their services even cheaper and more accessible than before. Here’s what you should do to make the best of this situation and start trading.

1. Find the Perfect Broker For You

Forex brokers offer many different financial instruments—currency pairs, cryptos, CFDs, spreads, etc.

You want a brokerage that offers what you need, is safe, has a great trading platform, and most of all—dirt cheap. Some of the top forex brokers in the US, as well as many top UK brokerages, fit that description perfectly.

2. Open a Brokerage Account

Once you find your perfect match, signing up is easy and fully digital. You just need to give the broker some personal info and make a small deposit (sometimes that deposit is zero).

Average spread EUR/USD standard

All-in cost EUR/USD — active

$0 for real stocks/ ETFs

Minimum initial deposit

Total currency pairs

Demo account?

Social / copy trading?

8.0/10 Visit Interactive Brokers on Interactive Brokers’ website

8.5/10 Visit eToro on eToro’s website

Average spread EUR/USD standard

All-in cost EUR/USD — active

$0 for real stocks/ ETFs

Minimum initial deposit

Total currency pairs

Demo account?

Social / copy trading?

8.5/10 Visit eToro on eToro’s website

9/10 Visit FOREX.com on FOREX.com’s website

Average spread EUR/USD standard

All-in cost EUR/USD — active

$0 for real stocks/ ETFs

Minimum initial deposit

Total currency pairs

Social / copy trading?

8.0/10 Visit Interactive Brokers on Interactive Brokers’ website

8.5/10 Visit eToro on eToro’s website

9/10 Visit FOREX.com on FOREX.com’s website

3. Practice and Learn

Almost all forex brokers have demo accounts. These are training accounts you can use to practice trading with virtual money instead of real cash.

This is a great way to learn how the platform works and see if your analytical ability is providing results. Some brokers offer great educational content that can bring you from zero to hero in no time—check out what the top forex brokers for beginners have in store for new traders.

4. Identify Opportunities and Close a Trade

Once you’ve set everything up, learned your strategies, and practiced a bit on the demo account, it’s time for the real deal. Analyze the markets to find a good opportunity, open a trade, and set stop and limit orders.

Looking for more advanced strategies? Learn about the ascending triangle.

What You Have to Know Before Trading Forex

If you’re completely new to forex then these strategies might not make complete sense—that’s because they use some concepts you must learn before you can go deeper into the mysteries of forex. Here are a few tips on how to prepare yourself if you’re new to the trading game.

Researching the Market Comes First

Opening a trade before researching the market is not what you want to do. The prices of different currencies might depend on completely unrelated factors because they are governed by different banks, institutions, and market conditions.

Forex is traded in an over-the-counter market (OTC)—this is a system of banks that hold copious amounts of currencies and sells them to traders (and buy from them) directly. Since banks have huge appetites, this means you can always find a buyer and seller for any sensible trade you wish to make.

The big banks that make up this forex network are called market makers for apparent reasons—they literally created the market—and they are spread across 4 major forex centers: Tokyo, Sydney, London, and New York.

Since these centers span all time zones, traders have 24-hour access to the global forex market and can trade whenever they wish. All this and more impacts the forex market, but learning how to trade forex should be your priority if you’re just starting.

Are you a UK-based trader? Take a look at the most popular UK forex brokers.

Find out what Influences Currency Prices

Many factors can affect the price of a currency—some are impossible to predict, but most can be anticipated if you just follow the right news. Like the economy at large, forex prices are pushed by supply and demand, but also some other “irrational” forces like mass psychology amid a financial crisis and so on.

The image above illustrates some of the main factors you can look at to analyze forex price changes. However, there’s always more to macroeconomics—let’s look into this in more detail:

- Central Banks Make the Rules – As the highest financial authorities in their countries, central banks can inflate and deflate currencies quickly through their decisions. For example, if you’re dealing with USD a lot, make sure you follow what the FED and the government are doing. As soon as a major decision is announced, traders start acting like it’s already been realized and prices change.

- News in General – Major news stories tend to spark traders’ imagination and cause a chain reaction that can influence currency prices. For example, a huge infrastructure project in a developing country is a sign their currency might be worth more in the future, so traders buy it and its price goes up quickly. Politics are very important here too.

- Trader Sentiment – If enough traders think that a currency is going bust and start selling—the currency will lose value dramatically. Even if the market isn’t thinking rationally, its opinion is important—that’s why you should consider market sentiment when trading.

- Your Broker’s Prices – This might not affect global price trends, but your broker’s pricing will massively impact your balance—and that’s the most important thing here. Before you start trading, make sure you find a cheap service and that you understand your broker’s commissions and fees.

Know the Risks of Trading Forex ⚠️

There are inherent risks to trading forex, and some that can leave you penniless before you even start trading. However, even a minefield is easy to navigate if there’s a marked safe path on it.

If you go online and look at forex brokerage reviews and the comments people put up, you’ll probably come to the conclusion that every single broker will steal your money. Although many brokerages are shady and scammy, this isn’t true for the real top forex brokers of the world.

However, brokers often won’t tell you everything you need to know and this is where problems arise. Read through the terms and conditions or check out a comprehensive review of a broker you like—a brokerage might freeze your funds for things like scalping and other actions it doesn’t allow (which are in the fine print of the terms and conditions document you agreed to).

Also, make sure your broker has negative balance protection, especially if you’re a beginner—here’s why. Since you need a lot of money to make significant profits with forex, brokerages can lend you money through margin trading.

This means you can borrow up to 10 or even 300 times your account balance and make a trade. If you win, that’s great, but if you lose, you can actually end up owing your broker money you don’t have—negative balance protection means that cannot happen, so look for it in every broker you research.

Beware—Forex Scams Are not Uncommon

The Forex market isn’t the most regulated machine in the world and scam brokers, investment advisors, and other schemes pop up every day. This goes double for the time we live in—fraudsters have become creative in the COVID-19 era and thousands of unsuspecting traders have fallen for never before seen tricks.

So, knowing how to avoid forex scams is key. The first thing you need to check is whether the brokerage you’re with is well-regulated. If it’s under the watchful eye of the main financial authorities in its country, that’s a good sign.

Also, watch out for “signal sellers”. These are companies or individuals who claim they can provide you with the latest price updates before everyone else gets them.

Even a small-time advantage is huge in forex trading, but don’t be too trusting. Most signal sellers are scammers and just want to get your money and disappear with it—be very skeptical when it comes to these things.

One more new threat is “robot sellers”. Essentially, they will claim to have a trading algorithm that can trade for you while you sleep and produce serious returns to boot.

There are trading algorithms out there but we’re still far off from having a truly effective forex trading robot that can just take the wheel for us. If you’re looking for a trading algorithm, be careful and research it as you would the market before making a big trade.

All reviews, research, news and assessments of any kind on The Tokenist are compiled using a strict editorial review process by our editorial team. Neither our writers nor our editors receive direct compensation of any kind to publish information on tokenist.com. Our company, Tokenist Media LLC, is community supported and may receive a small commission when you purchase products or services through links on our website. Click here for a full list of our partners and an in-depth explanation on how we get paid.

https://www.axi.com/int/blog/education/forex/forex-trading-strategies