Bill Williams’ Trading System

Bill Williams is a world famous trader, developer of analytical indicators and creator of Profitunity strategy. In 1987, his first works on trading in the stock market were published. The author violently criticized the traditional methods of analyzing graphs. In his opinion, fundamental and technical analytics lack objectiveness. Williams was convinced that a complex of random factors had a key influence on the pricing of a financial instrument. Later, Williams published a book «Trading Chaos», which was focused on the principles of fractal geometry. The author convincingly proved the existence of a variable pattern in the chaos of financial markets. The high popularity of this work can be explained by outstanding financial results of the author’s trade, rather than innovative methods of analyzing quotes. Indeed, during 2 years of trading in the stock market, Bill Williams managed to increase his capital from 10,000 to 200,000 USD. This result could not pass unnoticed by traders and many decided to introduce Williams’ trading approach into their own practice. The author himself was encouraged to open his own trading school — Profitunity Trading Group, which today is headed by his daughter — Justine Williams. Tuition fee is 6000 USD. The training course for traders at Profitunity Trading Group is aimed exclusively at studying and disclosing the features of B. Williams’s unique strategy.

Important! Indicators of B. Williams are included in the standard set of analytical tools of the MT4 platform and many traders have already managed to evaluate their «effectiveness» in practice. Enthusiasts have developed new strategies that have nothing to do with the «Profitunity» approach, so their effectiveness is not difficult to question. For example, no review of B. Williams’ strategy mentions that there are 2 methods for using fractals, but for some reason attention is focused on the less effective one. Let’s see what Bill Williams indicators really are, how the «Profitunity» strategy works and for what the «trading gurus» take from 1000 USD up?

Bill Williams Indicators and Traders’ Mistakes

- Alligator.

- Fractals

- Awesome oscillator.

Each indicator is integrated by default in MT4.

Attention! The first version of the strategy Profitunity was developed in the 80s of the last century. Since then, the principle of pricing of financial instruments has undergone significant changes. This was mainly influenced by a significant increase in the volatility of liquid assets. The main mistake of the authors of reviews and practicing traders is that the former superficially present the basic version of the vehicle, while the latter unsuccessfully try to use these recommendations in trading. Initially, the Profitunity strategy was developed for the stock market. Yes, Bill Williams himself said that his method would be effective regardless of the financial instrument chosen for trading, but a lot has changed.

To learn how to successfully use Williams indicators in your own trading, it is important to understand the main mistakes of traders.

Incorrect interpretation of trading signals

Unfortunately, there are so many radical errors in the descriptions of the principle of operation of the Bill Williams indicators that, to cover all, it will be necessary to consider each instrument separately:

Fractals. A peculiar pattern consisting of a minimum of 5 candles, the Hight or Low point of the average of which is higher / lower than the extreme.

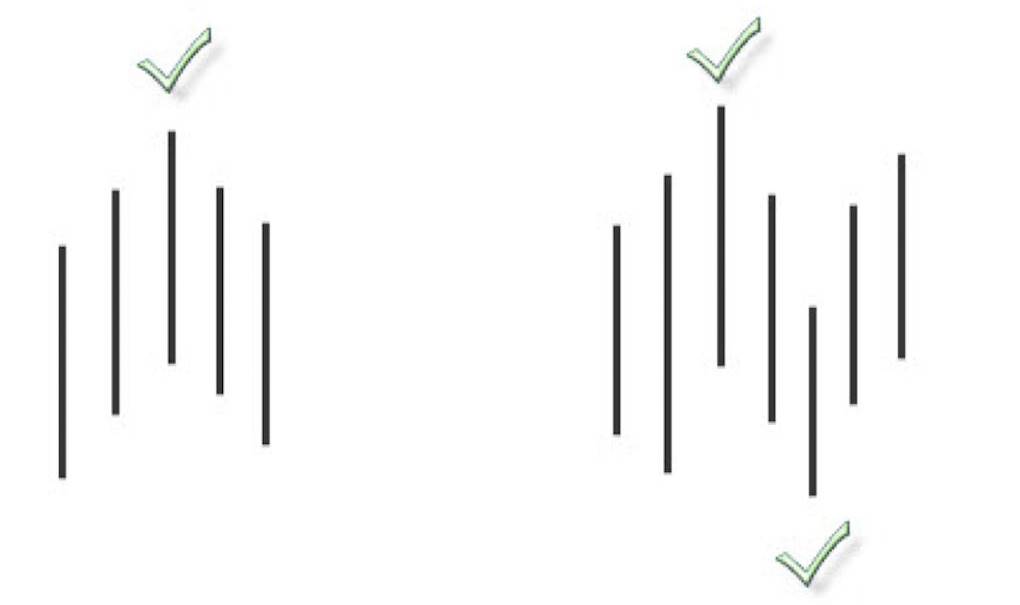

The indicator is displayed on the graph in MT4 as arrows:

In fact, fractals display local minima and maxima for minor periods. The only practical application of the indicators, according to the descriptions on the network, is placing a pending Stop order at the fractal level. However, in accordance with the rules of technical analysis, it is possible to open an order in the direction of the trend when the price rebounds from the local level. This principle of trade is discussed in detail in the book “Trading Chaos” by B. Williams. This is the way to use this indicator.

Alligator

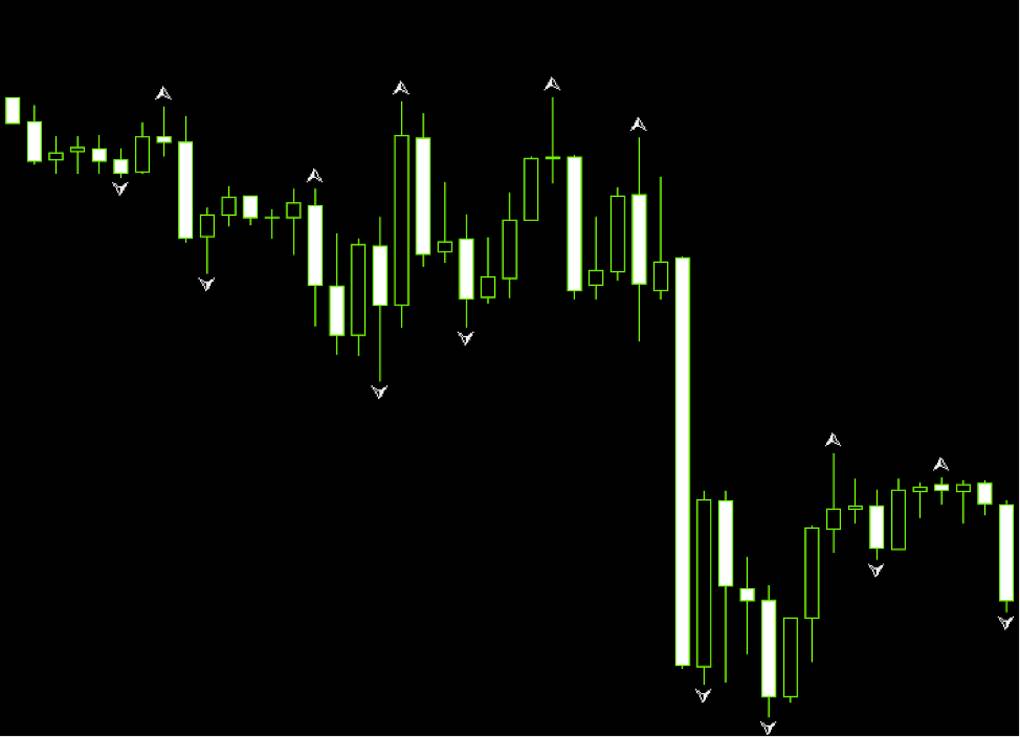

The instrument is based on 3 moving averages with periods of 13.8 and 5. When using the indicator in Forex trading, it is recommended to change the MA method in the settings to “Exponential”. This will make the formation of lines more sensitive to tick price changes. In developing this tool, the author was guided by the ideas of Sidus and Puria regarding the use of sliding in the analysis of financial markets. Not understanding this, novice traders blindly follow the recommendations presented in the network, according to which the order should be opened in the direction of the slips only if all lines are directed towards the current trend. The result is the following:

Horizontal lines marked points in turn in the market. You do not need to have significant experience in trading to understand the obvious thing: the signals are displayed after the movement has been worked out. Of the 3 signals presented in the screenshot, only one turned out to be profitable. That is why most traders use the alligator only as a trend indicator that serves as a filter of false signals. In fact, it is enough to make small changes in the interpretation of the signals of this instrument to make it an effective and key element in trading:

The true signal for opening an order is the intersection of a different line moving with a period of 5 with a period of 8. The points for opening trades are marked on the screenshot. As you can see, this significantly increases the efficiency of the indicator.

Awesome Oscillator.

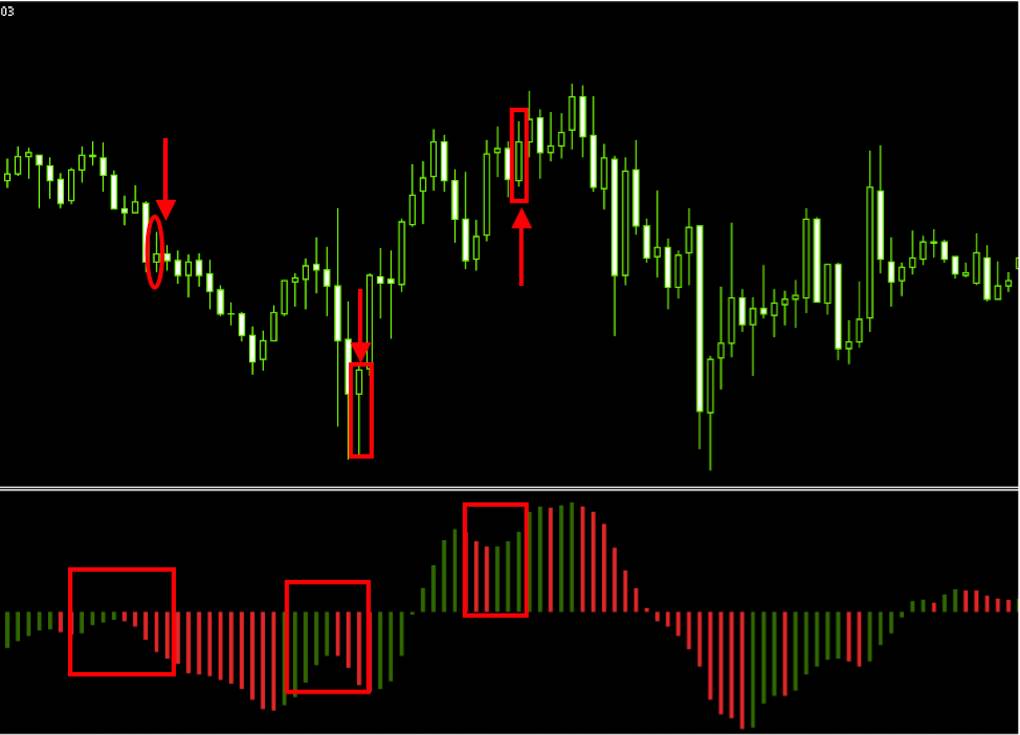

The possibilities of an awesome oscillator are greatly exaggerated by both the developer and the traders. This tool actually has nothing to do with the Profitunity strategy and was developed as an independent indicator. Awesome Oscillator is effective in currency futures trading, if it is used to detect divergences:

The control signal for opening a position is the histogram crossing the zero line in the direction of a potential trend. It is worth saying that the Awesome Oscillator reveals divergences much more efficiently than the popular MACD.

Of all the considered indicators, the latter enjoys special popularity, since, based on statistical studies, enthusiastic traders were able to derive several types of trading signals for this instrument.

Crossing the zero line. In practice, this signal is not effective, because it is very late.

Formation of 3 histogram bars in a row of the same color, regardless of their location in relation to the zero level. To be convinced of the harmful consequences of the use of such tactics in practice, it is enough to pay attention to the oscillator signals during consolidation periods, which account for about 70% of the total trading time:

When trading with these recommendations, the loss of the deposit is a matter of time.

Pattern «Saucer»

This method of applying the «magic» oscillator is also not related to the method of Bill Williams and was developed by unknown traders. The pattern consists of 6 bars of the histogram, which together form a shape similar to a saucer. Of these, 3 bars are red, and the rest are green. The opening of the order supposedly should be in the direction of the last three columns:

The screenshot shows a segment of the chart on which 3 trading signals are formed. Of these, 2 turned out to be unprofitable. Such statistics do not justify the use of strategy in practice. These signals are really effective with a pronounced trend, which happens quite rarely.

As you can see, none of the popular methods of using the Awesome Oscillator lead to the expected result. This tool is advisable to use only when trading futures solely to identify divergences.

Wrong timeframe selection

Another common mistake of traders who tried to use Bill Williams indicators in trading is wrong timeframe selection. The key elements in the Profitunity strategy are fractals and the Alligator. These indicators can be called trend indicators, so their use for the analysis of graphs with periods M1-M30 is impractical. The fact is that on these timeframes market noise prevails, which prevents the correct operation of analytical tools. The optimal period for trading Williams indicators is H4.

How to use Williams trading strategy effectively

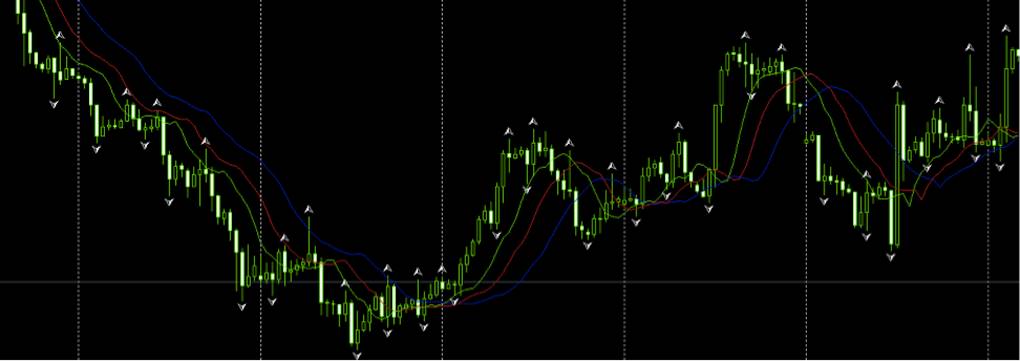

For trading, you will need to install the Fractals and Alligator indicators with standard input parameters on the chart. The finished template will look something like this:

To open a Buy order, you will need to wait for the following confirmations:

Green sliding crosses red from bottom to top.

The last fractal is pointing down.

To open an order Sell signals are mirrored. Stop Loss is set at the level of the last fractal. Placing a take profit is not necessary, but the value of this order can be fixed and make up to 70% of the average daily volatility of the asset selected for trading.

To understand the principle of trade and evaluate the effectiveness of the strategy, it is recommended to pay attention to a few examples:

On the presented graph, 5 signals for opening positions were formed. You should consider each of them in more detail:

The transaction is opened in accordance with the rules of trade. The vertical line is the entry point. Exit from the transaction is carried out after the formation of the opposite fractal. The result is a fixed profit of 240 points.

The upward local trend is still relevant, and the re-formation of a fractal in the relevant direction gives grounds for placing a trade order.

The situation is completely analogous to that considered in point 2.

Against the background of high liquidity, the Alligator displays a false signal to open a Buy order, but the last fractal is bearish, so refrain from trading.

As can be seen, the integrated use of the indicators Alligator and Fractals is more than effective. Fractals not only play the role of a good filter, but also display the most correct points for taking profits. Now it is recommended to pay attention to the signals of these indicators during periods of consolidation.

With lateral movement of the chart, a mass of false signals is displayed, the vast majority of which effectively filter fractals. As a result, only 3 convincing signals were formed, 2 of which closed with insignificant, and 3 with good financial results.

Attention! When trading with the Profitunity system, the risk for each order should not exceed 2-3% of the deposit. The optimal period is H4. The potential return is up to 20% per month, depending on the volatility of the currency pair. If it seems that this is not enough, then you should pay attention to the profitability of bank deposits or mutual funds.

Novice traders are advised not to trade more than 2 financial instruments.

Conclusion

Based on the information provided, we can conclude: Bill Williams indicators and Profitunity strategy are effective. By applying them in practice it is possible to achieve a stable profit. The main problem of most traders was the incorrect interpretation of trading signals.

Author: Kate Solano, Forex-Ratings.com

Share: Tweet this or Share on Facebook

Creating a Forex Trading System: 5 Steps To Great Success (2023 Update)

15 Price Action Patterns Insiders are Using If a hedge fund managers were using 15 specific price action patterns would you want to know?

Hi traders, today I want to talk to you about what a Successful Forex Trading System is all about!

As shown in the graphic below, a good strategy is a structure built on some critical foundations.

When creating a forex trading system, it must be supported by an accurate entry strategy and a detailed trade management plan. You’ll need rigid risk management guidelines, implementation of practical tools, and a comprehensive trading plan. By the end of this article, you have everything you need to be able to develop your own forex trading system.

If you’re just getting into forex, not to worry. You may be interested in our How to Trade Forex for Beginner’s Guide.

Table of Contents hide

Creating A Forex Trading System Entry Strategy:

The entry strategy is critical to the success of a system. The entry strategy, above all else, must put you in a position to make a profit. It is the entry strategy that decides at what point and for what reason you are going to risk your hard-earned dollars, so you must be confident in it!

Again, the most important element of an Entry Strategy is to set yourself up for success and give yourself profit potential. Your entry strategy does not need to be perfect. It only needs to give your system a chance to make consistent profits.

A common entry strategy with a great system around it is better than a great entry strategy with no system around it!

Trade Management:

Your trade management strategy describes how you will handle a trade after making the entry. The most important part of your Trade Management strategy is having it written out in your plan. You must know how you are going to handle the trade ahead of time so that you are not making rash, emotional decisions with money on the line.

Swing Trading Report Get Our Free Swing Trading Strategy

Get Our Free Swing Trading Report Today!

- Entry Points

- Exit Points

- Risk Managament

- Time Saving Tips

Emotions are probably the most complicated aspect of developing your plan because there are so many things to consider when you have a live trade in the market. Here are just a few of the possibilities that you need to have a plan for before you ever take the trade:

- Is there a hard profit target?

- Is there a trailing stop?

- What system do you use to trail the stop?

- When does the trailing stop kick in?

- Do you take partial profit?

- How much profit do you take?

- When do you take partial profit?

- How many times do you take partial profit?

- Is there a point where you would add to the trade?

- Will you add if it is winning or losing?

- At what percent of winning or losing will you add?

- How much will you add?

- Is there a point where you would add a hedged position?

- When would you add a hedged position?

- How much of a hedged position would you add?

- Should you ever pull the entire trade off before it hits a stop or target?

- How do you handle the trade if the news is coming out?

- How do you manage the trade if other trades are in play?

- Do you leave your trading station with a live trade on?

- How do you set up a live trade if you are leaving or going to bed?

- How do you handle a trade if it is struggling at support or resistance?

- What do you do if you accidentally enter an incorrect size on the trade?

- How long will you hold a trade if it is floating around the same price?

- Will you take an entry on a pair if you are already in the same direction on a correlating pair?

- How many trades will you take on at once?

- Will you hold a trade over the weekend?

- Will you keep trades that earning negative interest in your account?

- How long will you hold a trade that is receiving a negative swap?

- What if there is a signal, according to your entry rules, in the opposite direction before you get out of the trade?

All of these things and a lot more are things that a trader could do with a live trade in play, and all of them should be planned beforehand of time with a strict set of guidelines. If any of these things apply to how you would manage your trade, you should have a detailed plan written out as to how you execute the management strategy.

Hopefully, that gives you an idea of how to implement your trade management strategy.

Risk Management:

Risk management is vital to successful trading in any way. There will be no way to create the best forex strategy system unless you have a solid risk management plan.

Your risk management plan is your guide to exactly how much money you will put on the line for a given trade.

It will be impossible for you to make money on any consistent basis without a solid risk management plan in place. You can’t build on capital until you master preserving capital.

Consistency in your risk management is critical to your success. Risking different amounts of money on various trades (without a strategic reason for doing so) is a simple way to get yourself in trouble.

For instance, something that many beginner traders struggle with is increasing the size of their trade only because they are hoping to make more money.

Increasing trade size is a recipe for disaster because it means that there is no logical way for their system to be profitable. They may have won a lot of trades, but if they lose on one where their risk is out of control, they’ll be at a net loss regardless of their track record.

Remember, trading is about math. If you win five trades at a 1/1 Risk to Reward ratio and are risking 1% per trade, and you made 5%, that’s great. But what you have to guard yourself against doing is then deciding to risk 2%. If you lose three trades, you are at a net loss even though you want the majority of your trades at a 1:1 ratio.

Check out this article on a day trading Forex strategy!

Trading is hard enough as it is. You can’t afford to handicap yourself by not being consistent. You’ll lose money even when you are trading well!

One of the most frustrating things about trading is that even when you are making good trades, it doesn’t mean you are making money. You can be up hundreds of pips and still be losing money if you are not managing your risk well. This is why being consistent with your risk management strategy is so important.

Forex Indicators & Tools:

A trader’s tools are a critical part of his success.

The success of free forex systems that work requires you to use what you have effectively, and that certainly includes the implementation of tools. Depending on your particular strategy, the tools you use may be very different than another successful trader. What’s important is that you are using the instruments to increase profitability.

Your tools may consist of your trading platform, your computer with multiple monitors, signal software or alerts, indicators, a trading mentor, etc.

There are a host of tools out there that you can use to your benefit. However, one must always be careful not to over-complicate the system with all that is out there. One of the most common things we see are traders who over-complicate things by trying to incorporate every tool out there.

What’s important to understand is that, although there are thousands of tools out there that could potentially benefit, they are not all necessarily going to work in conjunction with your strategy or with one another.

In my opinion, it is important to have a few critical tools that you are comfortable and confident with that can help you become a more profitable trader.

Hopefully, that gives you an idea of what a useful tool is and how it can benefit your trading system.

Plan:

Your plan is what ties all of these things together. Without a plan to execute your entry strategy, risk management or money management there is no way you will be successful. Click here to view a trading plan template.

Your plan should include a very detailed set of directions for exactly how all of the components tie together.

Not only should your plan include the steps for the execution of the different aspects of your system, but it should also list your goals. Detail, in your plan, what you wish to accomplish by successfully executing your trading system.

Again, the plan is what puts all of these components together and sets you up for success. The indication of a great plan knows that if you follow it, you will succeed!

Thank you for reading!

Please leave a comment below if you have any questions about Forex Trading System.

Also, please give this strategy a 5 star if you enjoyed it!

Frequently Asked Questions

Q: What is a forex trading system?

A: A forex trading system is a set of rules that you predetermine to make consistent, informed decisions in trading the Forex market.

Q: What are the benefits of using a forex trading system?

A: Increased consistency in trading decisions; the ability to backtest and optimize strategies; and the ability to reduce emotional bias in trading are all great benefits of creating your own system.

Q: How do I choose a forex trading system?

A: To choose a forex trading system, decide in advance what trading goals, style, and level of risk you are comfortable with. Also, consider the amount of time and effort you are willing to dedicate to learning and implementing the system.

Q: What are some popular forex trading systems?

A: Some popular forex trading systems include trend-following, breakout, and swing trading systems.

Q: How can I backtest a forex trading system?

A: You can backtest a forex trading system by using historical data to simulate trading decisions based on the rules and strategies of the system.

Q: What is a forex trading strategy?

A: A forex trading strategy is a specific approach or method used to make trading decisions in the forex market.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

As you found this post useful.

Follow us on social media!

We are sorry that this post was not useful for you!

Let us improve this post!

Tell us how we can improve this post?

15 Price Action Patterns Insiders are Using If a hedge fund managers were using 15 specific price action patterns would you want to know?

47 Comments

Leave a Reply Cancel Reply

Dassana

Hi Nathan,

Great article… I guess rules will be much simpler if you scalp.

I always hear that institutional dealers always specialized in one currency pair. But most of the time retail investors try to be master of all… so the question is should we just concentrate on one pair and be the best on that pair or look at all the opportunities?

Cheers

Dassana Jayalath

caseystubbs

I think that all depends on your personal trading style.

Forex Systems Reviews

Great sharing… Yeah it is right that once we have set up specific entry rules, solid risk management, and a

complete trade management guide, we are on our way to having a Forex

Trading System.

caseystubbs

yes those are some key components to a great system.

Tony College

Great article, it’s so important to not overlook the basics. Over looking the basics is like trying to build a house without a foundation, won’t last too long in this windy market.

John

What a great Tool! It must save huge amounts of time in setting up and managing trades. Is it available to ordinary traders like me?

https://www.forex-ratings.com/forex-strategies/?id=28544