How To Trade Forex

Andrew’s work experience in finance includes experience as an institutional broker, a derivatives pricing system designer, an international banker and trader, and a program manager for managed account offerings. He has studied price dynamics and financial market pricing in multiple markets for more than thirty years. Andrew has also worked as a fundraiser for various non-profits. His consulting work includes advising investors on financial market trading strategies, and assisting non-profit and for-profit companies/organizations with their strategic planning and business operations. Andrew obtained his BA at Washington University in St. Louis, and a MBA with honors at Fordham University in New York City. He holds a FINRA series 65 license, and a NY state property and casualty insurance license.

Updated March 10, 2024

Reviewed by

Reviewed by Samantha Silberstein

Samantha (Sam) Silberstein, CFP®, CSLP®, EA, is an experienced financial consultant. She has a demonstrated history of working in both institutional and retail environments, from broker-dealers to RIAs. She is a current CFA level 3 candidate and also has her FINRA Series 7 and 63 licenses. Throughout her career, Samantha has used her expertise and various licenses and certifications to provide in-depth advice about household and business-specific financial planning, investing, credit cards, debt, student loans, taxes, retirement, and income strategies.

Fact checked by

Fact checked by David Rubin

David is comprehensively experienced in many facets of financial and legal research and publishing. As a Dotdash fact checker since 2020, he has validated over 1,100 articles on a wide range of financial and investment topics.

:max_bytes(150000):strip_icc()/Primary-Image-how-to-trade-forex-7499569-44467e75edf24375a03f63fe6f791310.jpg)

The foreign exchange market, also known as the forex (FX) or currency market, is the largest and most liquid market in the world. It represents the exchange of one nation’s currency for another, and is used for everything from travelers exchanging currencies to global financing. With over $7.5 trillion in currencies traded daily, the FX market impacts consumers in a global market, affecting the price of imported and exported goods. To put this in perspective, the five-day Average Daily Trading Volume (ADTV) for US stock and options traded daily is around $400 billion as of 2024. While the forex market is huge, 75% of FX trading is conducted in the seven major currency pairs, all of which include the U.S. dollar (USD), with participants including governments, large international banks, regional banks, corporations, and individuals.

Foreign exchange trading continues 24 hours a day, with only the trading centers changing throughout the day. We’ll look at how the forex market works and what you need to know to trade in the financial world’s biggest and busiest arena.

How To Trade Forex

Trading foreign exchange markets involves buying or selling one currency in exchange for another. The goal of trading is to profit from the changes in exchange rates between the two currencies. To trade forex, you will need to open a trading account with a broker that provides access to the FX market. After opening an account, you will need to deposit funds to use for trading.

Once you have funds in your account, you can start trading by placing buy or sell orders for currency pairs. These orders can be placed through the broker’s trading platform, which provides access to real-time pricing information and charts. To be successful in trading forex, you will need to develop a trading strategy that takes into account factors such as market conditions, news events, and chart analysis. Trades are sized in lots, with the standard lot representing 100,000 of the base currency (first of the pair). If you put a buy order in for USD/CAD, for example, you are betting on the U.S. dollar appreciating against the Canadian dollar, and this is considered a long position. If you put in a sell order for USD/CAD, you are betting on the Canadian dollar appreciating against the U.S. dollar, and it is a short position.

Foreign exchange traders typically utilize technical analysis for their trading, and many also use fundamental analysis to gauge the relative strength of global economies. It is also important to manage your risk by using stop-loss orders and proper position sizing. Before placing a trade, you want to know your entry level as well as your exit points for taking profits or minimizing losses. Trading forex can be challenging, but with the right knowledge and discipline, it can be a rewarding and profitable experience.

Steps Required To Trade Forex

Getting started trading forex is relatively straightforward. While there are some differences in opening a traditional stock trading account vs. a FX brokerage account, the overall steps are largely the same.

Step 1: Research and select a broker. The first step is to find out which brokers will offer you a foreign exchange trading account. If your existing broker supports FX trading and you have an approved margin agreement, you can skip ahead and begin trading. If not, you’ll want to look at FX brokers and compare them in terms of platform capabilities, regulatory compliance, fees, margin rates, and customer support. Investopedia does a regular roundup of forex-focused brokers to consider, and there are also large, traditional brokers worth considering. Once you’ve identified a broker that fits your needs, opening a forex trading account is a fast and easy process.

Step 2: Open a forex trading account. To open an account, you need to provide personal information, including name, address, tax ID number, and some financial background information. You will also have to answer some questions about your finances and investment goals as part of “know your client” compliance.

When you open a FX trading account, it will include the execution of a margin agreement, because currency trading includes leverage. An options agreement will be required to trade currency options, which can be accomplished through either over-the-counter (OTC) options offered by some of the forex brokers or exchange-traded options on currency futures.

Step 3: Verify your identity. Your broker will confirm your identity through your passport, license, or national ID. A copy of a utility bill or bank statement will also assist with verifying your address. The broker requests the financial and tax information to comply with U.S. government laws and Commodity Futures Trading Commission (CFTC) rules.

Once your account and margin agreements have been approved, you need to fund the account to start trading. It should be noted, however, that some of the leading online forex companies do not offer accounts to U.S. customers.

Step 4: Fund your forex account. Once your account has been approved, you need to fund it in order to begin trading. Some forex platforms allow you to begin trading with as little as $100, which at the 2% margin (or 50:1 leverage) available for some markets, allows for a position of $5,000. Funding is typically accomplished by ACH bank transfer, wire transfer, debit card (after verification), or check.

Step 5: Research currencies and identify trading opportunities. Once the account is open and funded, forex traders typically choose the currency pairs they want to trade, then utilize technical analysis to determine their timing points and price levels for trade entry and exit. Like all markets, but especially leveraged markets like foreign exchange, trade size and trade management are very important to achieve the preservation of capital on losing trades and growth of capital on profitable ones.

The overall financial condition of a country, including interest rates, plays into the value of a nation’s currency, so there is a place for fundamental analysis in currency trading. News and fundamental data releases can also have a large impact on currency values. Beyond fundamental considerations, however, technical analysis is a critical part of currency trading because of the often fast-moving currency markets. Many traders focus exclusively on technical analysis to capitalize on the price action of the forex market, using common technical techniques such as trend lines, channels, breakouts, patterns, and support and resistance levels to identify trading opportunities in the foreign exchange markets.

Step 6: Size up your first forex trade. Before making their first FX trade, every trader needs to understand how much capital they have, as well as the specific leverage available to them for their chosen currency pair. Since leverage in forex trading can be as high as 50:1, it is critical to understand how much capital you will have at risk on any trade. The 1% rule for how much capital to risk on an individual trade is a good rule of thumb for new forex traders. This means you should only risk 1% of your total account value on a particular trade. Other traders may choose to use a 2% or even 5% rule for the amount of capital they will allocate to any particular trade.

The amount you are willing to risk along with how far you are willing to let the market move against your position before taking a loss sets the parameters of the trade. You should also set a take-profit point if you intend to systemize your trading, but with the downside risk contained, you always have the option of letting winning positions run. Once the trade parameters have been determined, you are ready to enter the order through your broker’s trading platform.

Step 7: Monitor and manage your position. Once the position has been established, the trader should have a clear understanding of their position and, through their research prior to trading, have clear exit points for either taking profits or taking a loss on their trade. Many traders will use a one-cancels-the-other (OCO) so that they will automatically take their profit or loss should either of these levels be reached, and cancel the remaining order.

Compare the Best Forex Brokers

| Company | Fees | Account Minimum |

|---|---|---|

| IG | Spread cost; Overnight financing costs; Inactivity fees | $250 |

| XTB | Spread cost; Commissions; Overnight financing costs; Inactivity fees | $0 |

| Plus500 | Spread cost; Overnight financing costs; Inactivity fees; Currency conversion; Guaranteed stop order | Varies with instrument |

What You Need To Open a Forex Account

To open a forex account with a broker, you simply need to provide your personal information and fund the account.

Personal Information

- Account information: Brokers often prompt you to create an account as the first step of onboarding. This generally involves providing an email, creating a password, and verifying the account.

- Personal information: You will need to provide your full name, date of birth, and contact details including mailing address, email (if not already provided), and phone number.

- ID verification: You will need to provide a copy of government-issued ID, such as a driver’s license or passport, to verify your identity.

- Proof of address: You will need a bill or a bank statement that shows your name and address to confirm residency.

- Know your client information: You will be asked about your occupation, income, and investment information along with other questions to assess your financial situation, trading experience, and risk tolerance.

- Financial information: Your bank account details may be requested for setting up funding via bank transfers.

Minimum Deposits

The minimum deposits for forex trading accounts can be quite low and may not even apply at all. Due to the role of leverage in forex trading, however, it is a good idea to have enough risk capital in the account to actually engage in meaningful trading. Even if you can open an account with a $0 minimum, trading with smaller account balances is difficult and can severely limit the range of price action you can handle on any one position. Although there is no hard and fast rule, a balance of $2,500 in risk capital is a good starting point for developing your FX trading skills.

Understand the Basics

In currency trading, the first currency listed is the base currency, and the second currency is the quote currency. For example:

USD/JPY 134.82

The USD/JPY currency pair is made up of the U.S. dollar as the base currency and the Japanese yen as the quote currency. The base currency is always one unit of currency, in this case, $1, and the quote currency is the figure that changes. In this example, $1 USD can buy 134.82 Japanese yen. Throughout the day, this value will fluctuate up and down based on trading activity.

Transacting in the most common currency pairs is typically very easy because these markets are very liquid, and have very narrow bid/offer spreads. Another important forex trading term is a pip, which is the smallest increment a market trades in. This is typically 0.0001, although it is 0.01 for USD/JPY. Spreads in FX are now so narrow that many of the currency pairs trade in tenths of a pip (out to a fifth decimal place; or a third for USD/JPY).

In EUR/USD (euro/U.S. dollar) trading, the euro is the base currency, and the quoted rate represents the dollars that each euro buys. Beyond these specialized terms, the foreign exchange market trades like other markets, where there are bids and offers for buying and selling that create price action in the market. Like other markets, you also have access to trading orders, such as limit and stop loss orders, for entering, managing, and exiting positions.

In addition to outright trading of currencies, some forex brokers offer contracts for difference (CFD) for currencies and some commodities. These contracts allow traders to use significant leverage, up to 1000:1, for trading currencies where there is no transfer of assets. Instead, they only settle the difference in value. That said, there are additional risks with contracts for differences that investors need to consider.

U.S. investors do not have the ability to trade CFDs. The Securities and Exchange Commission (SEC) and the CFTC prohibit U.S. citizens from trading these assets as they do not pass through regulated exchanges.

Options for Trading Forex

There are multiple options for trading foreign exchange. They include trading directly with a bank or financial services provider, trading currency futures listed on exchanges through a commodity trading account, and opening an account with a foreign exchange broker that essentially provides individual traders with access to the interbank market through its own platform.

Know the Risks

Like any trading market, FX trading involves risk. Forex trading can be volatile, as markets can adjust very quickly to new information and news. While this is similar to many other markets, the market participants in forex also include central banks. With the largest banks making up a large share of the market, prices can fluctuate greatly during the day. Simply put, retail forex traders are small fish in a large ocean. While this volatility and price action appeals to many traders, the price swings involved also add to the risk of getting stopped out of positions and experiencing slippage on price fills.

Moreover, leverage in currency trading is significantly greater than stocks, with some brokers offering up to 50:1 leverage on more liquid currency pairs. This is significantly greater leverage than the 2:1 leverage offered to stock traders that establish short positions. Leverage presents greater profitability to traders, but that opportunity also involves commensurate risk on losses. The supercharging effect of leverage makes trade selection, size, and position management very important for controlling risks. It should also be noted that less active currency pairs may have even more extreme moves due to having less liquidity.

Types of Forex Markets

The first step in trading foreign exchange is learning about the market itself. The types of foreign exchange trading include spot, forward, and futures.

Spot Forex Market

Spot foreign exchange is the outright exchange of one currency for another at the time of the trade for a specific exchange rate. Spot FX trades typically settle with the actual exchange of currencies at the rate traded two days after the trade. There are some exceptions to the spot plus two-day settlement, most notably USD/CAD (US dollar vs. Canadian dollar) which settles one day after the trade date. When people are talking about the FX market, they are usually talking about the spot currency market.

Forward Forex Market

Forward foreign exchange represents a contract between two parties to exchange a set amount of one currency for a set amount of another currency on a specific date in the future. The difference in this future FX rate from the current spot rate is a function of interest rate differentials. While the specifics of forward forex trading are not standardized, the market provides users with the flexibility to hedge specific risk amounts over specific days. An example would be locking in the forward foreign exchange rate for a company that needs to meet a payroll for a specific amount on a specific date.

Counterparties trying to set a fair currency rate for the future will use the current spot exchange rate, then adjust it based on interest rate differentials for the time period of the transaction. This adjustment is made to compensate the participant with exposure to the currency that has the lower interest rate.

Futures Forex Market

There are also exchange-traded futures contracts, which are similar to forward foreign exchange, but have fixed contract terms and trade on regulated futures exchanges. Currency futures contracts in the US are based on one currency, and the contract is cash settled in US dollars. While these markets are standardized, they do not allow users to hedge specific date risks or amounts, all of which is possible in the forward forex market.

Factors To Consider When Opening a Forex Account

There are a number of factors to consider when opening a foreign exchange account. Factors to consider include the commissions and fees charged, minimum investment amounts for both funding the account and position size, and the number of currency pairs available to trade. Other considerations include the research tools and trading platform, whether demo accounts are available for practice, and the quality of the broker’s customer service.

Fees: Brokerage fees for foreign exchange trading are generally very reasonable. There are two primary payment methods. One is to pay brokerage on trades, which usually work as a rate on the notional amount traded and are tiered lower for higher trading volumes. The other primary method is no brokerage fee, but wider bid/offer spreads that price the brokers’ fees into the trading price. Whether you prefer to pay your fees as basis points on the trade size or through pricing spreads will likely depend on how actively you are trading and the average trade size.

Account minimums: Account minimums for foreign exchange brokerage are generally very low. Accounts can typically be opened without any money, and funding requirements can be as low as $100. As mentioned previously, however, you will want more than $100 in the account to really begin trading.

Number and quality of supported markets: Some brokers support up to 200 currency pairs, but there is a great difference in liquidity in the various markets. The top seven most actively traded currency pairs represent 75% of all FX trading, and these markets are very active. Once you get beyond these currency pairs, there is a wide difference in liquidity. Traders can access less actively traded pairs by creating positions using the U.S. dollar as the pivot. As most currencies have a U.S. dollar pair, you can take up offsetting positions to create a synthetic currency pair. There would be an available market for this much less active currency pair, but the spreads would be wider and there would not be nearly as much liquidity in this market.

Research tools: Research tools, such as the quality of technical analysis and fundamental news, are also important factors for a foreign exchange trader. How fast these tools populate data becomes very important for trading fast-moving currency markets. Equally important, whether these tools integrate smoothly into the trading platform can make a difference in the trading experience. Some of the best interfaces allow for smooth indicator overlays and trading directly from charts. Some traders may want to be able to integrate their current charting or third-party analytical tools into their chosen platform for currency trading, so that is another potential consideration.

Demo account: Demo accounts are a great way to become familiar with trading a particular market on a broker’s platform. Traders new to forex trading would be smart to choose a broker with demo trading so they can learn how to place orders and manage positions effectively without having to commit capital first. Demo accounts allow users to become comfortable with the platform and its various tools prior to trading for their own account.

Customer service: While many forex traders are comfortable using the trading platform of their chosen FX broker, newer customers may want to consider the quality of customer service offered by their broker. Some are quicker to answer the phone, and others less so. Brokers may also have automated assistance and chat functionality to assist customers.

FAQs

Is Trading Forex Difficult?

Trading in the foreign exchange markets is not necessarily more difficult to trade than other markets. As with all markets, forex has its pros and cons, but the basic market structure is the same. A trader buys or sells a particular amount of a chosen asset and then manages risk through stops and profit-taking levels. The forex market, similar to futures markets, has a tendency to move quickly and can be volatile. It also involves using margin leverage where a trader only needs to post a small percentage of the full value of their positions. This can lead to either large gains or losses, and sometimes both in the same trading session. The fast moves in forex, coupled with the high leverage of retail currency trading, means it is critical for traders to manage their risk appropriately. As mentioned, this is done through taking appropriately sized positions and employing disciplined risk-management techniques with stop-losses.

How Much Money Do You Need To Start Trading?

While some forex trading platforms will let you start trading with as little as $100, this is a very small amount considering the risks involved with trading the highly leveraged foreign exchange markets. Here again, there are pros and cons to trading in this highly leveraged market.

While a disciplined trader will keep their risk consistent regardless of their capital level, trading with a smaller stake means that getting a bad fill on a stop loss when a fast-moving market shoots through your stop level could result in an outsize loss of capital. There is very little room for error with a small amount of capital. Realistically, capital of at least $2,500 should be used, and even this is a relatively small amount. Trading accounts to be used in fast-moving markets, like foreign exchange, should account for some margin of error and the unexpected.

Can You Cash Out Your Forex Account?

A trader can always cash out of their forex account. All they have to do is liquidate their trading position, wait for settlement, and transfer the funds out of the account.

Who Trades Forex?

Forex trading involves all the usual suspects, like retail traders, large investment banks, regional banks, private wealth management firms, corporations, and so on. Unlike other financial markets, however, governments are also active participants in the foreign exchange markets. Other primary FX market participants include the large international banks that make up the interbank market. The interbank market for foreign exchange is available to the other market participants through direct transactions with banks or through other market brokers. Some of these market brokers include platforms making foreign exchange trading available to individual traders.

Can You Lose Money Trading Forex?

As with every type of investing, the risk of losing money is the price you pay for the opportunity to make more money. While forex markets are now easily traded, most new to FX trading lose money because, like futures markets, forex combines leverage with fast-moving price action. Risk management is critical in forex markets, and that means properly sizing your positions and using the market order tools to stem losses quickly. Forex traders who don’t master these basics do not stay forex traders for very long.

What is Forex trading?

Learn how to become a forex trader with our comprehensive guide.

Forex trading for beginners

The foreign exchange market, also known as the forex market, is the world’s most traded financial market. We’re committed to ensuring our clients have the best education, tools, platforms, and accounts to navigate this market and trade forex.

If you’re not sure where to start when it comes to forex, you’re in the right place.

You’ll find everything you need to know about forex trading, what it is, how it works and how to start trading.

Jump to your chapter of interest

What is forex trading?

Forex is short for foreign exchange – the transaction of changing one currency into another currency. This process can be performed for a variety of reasons including commercial, tourism and to enable international trade.

Forex is traded on the forex market, which is open to buy and sell currencies 24 hours a day, five days a week and is used by banks, businesses, investment firms, hedge funds and retail traders.

What is the forex market?

The forex market is by far the largest and most liquid financial market in the world, with an estimated average global daily turnover of more than US$6.5 trillion — which has risen from $5 trillion just a few years ago.

One critical feature of the forex market is that there is no central marketplace or exchange in a central location, as all trading is done electronically via computer networks. This is known as an over the counter (OTC) market.

What is FX?

The foreign exchange (also known as forex or FX) market refers to the global marketplace where banks, institutions and investors trade and speculate on national currencies.

Summarising the basics of forex trading

What is forex trading?

Forex trading is the process of speculating on currency prices to potentially make a profit. Currencies are traded in pairs, so by exchanging one currency for another, a trader is speculating on whether one currency will rise or fall in value against the other.

The value of a currency pair is influenced by trade flows, economic, political and geopolitical events which affect the supply and demand of forex. This creates daily volatility that may offer a forex trader new opportunities. Online trading platforms provided by global brokers like FXTM mean you can buy and sell currencies from your phone, laptop, tablet or PC.

What is an online forex broker?

An online forex broker acts as an intermediary, enabling retail traders to access online trading platforms to speculate on currencies and their price movements.

Most online brokers will offer leverage to individual traders, which allows them to control a large forex position with a small deposit. It is important to remember that profits and losses are magnified when trading with leverage.

FXTM offers a number of different trading accounts, each providing services and features tailored to a clients’ individual trading objectives.

Discover the account that’s right for you by visiting our account page. If you’re new to forex, you can begin exploring the markets by trading on our demo account, risk-free.

Why trade forex?

Forex offers many benefits to retail traders.

You can trade around the clock in different sessions across the globe, as the forex market is not traded through a central exchange like a stock market. This means you can jump on volatility, wherever it happens. High liquidity also enables you to execute your orders quickly and effortlessly.

Trading forex using leverage allows you to open a position by putting up only a portion of the full trade value. You can also go long (buy) or short (sell) depending on whether you think a forex pair’s value will rise or fall.

Forex trading offers constant opportunities across a wide range of FX pairs. FXTM’s comprehensive range of educational resources are a perfect way to get started and improve your trading knowledge.

Join us

Start trading with FXTM

No one makes it easier. Open an account or try our demo account to get started while you build your skills.

Understanding currency pairs

All transactions made on the forex market involve the simultaneous buying and selling of two currencies.

This ‘currency pair’ is made up of a base currency and a quote currency, whereby you sell one to purchase another. The price for a pair is how much of the quote currency it costs to buy one unit of the base currency. You can make a profit by correctly forecasting the price move of a currency pair.

FXTM offers hundreds of combinations of currency pairs to trade including the majors which are the most popular traded pairs in the forex market. These include the Euro against the US Dollar, the US Dollar against the Japanese Yen and the British Pound against the US Dollar.

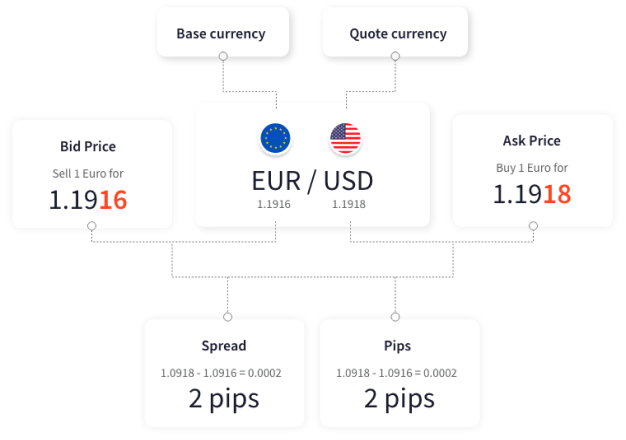

The diagram on the left looks at the most traded currency pair (EUR/USD) in the forex market and breaks down its essential components

For most currency pairs, a pip is the fourth decimal place, the main exception being the Japanese Yen where a pip is the second decimal place.

On the forex market, trades in currencies are often worth millions, so small bid-ask price differences (i.e. several pips) can soon add up to a significant profit. Of course, such large trading volumes mean a small spread can also equate to significant losses.

Trading forex is risky, so always trade carefully and implement risk management tools and techniques.

Essential components of currency pair trading

Base currency

The base currency is the first currency that appears in a forex pair and is always quoted on the left. This currency is bought or sold in exchange for the quote currency and is always worth 1.

Based on the example above, it will cost a trader 1.1918 USD to buy 1 EUR.

Alternatively, a trader could sell 1 EUR for 1.1916 USD.

Bid price

The bid price is the value at which a trader is prepared to sell a currency. This price is usually to the left of the quote and often in red.

The bid price is given in real time and is constantly updating as it is a live market.

Quote currency

The second currency of a currency pair is called the quote currency and is always on the right.

In EUR/USD for example, USD is the quote currency and shows how much of the quote currency you’ll exchange for 1 unit of the base currency.

Ask price

The ask price is the value at which a trader accepts to buy a currency or is the lowest price a seller is willing to accept. This is usually to the right and in blue.

The ask price is given in real time and is constantly changing as it is a live market.

Understanding spreads and pip in forex

Spread

As a forex trader, you’ll notice that the bid price is always higher than the ask price. The difference between these two prices is the spread. In other words, it is the cost of trading. The narrower the spread, the cheaper it costs. The wider the spread, the more expensive it is.

For example, if EUR/USD is trading with an ask price of 1.1918 and a bid price of 1.1916, then the spread will be the ask price minus the bid price. In this case, 0.0002.

In order to make a profit in foreign exchange trading, you’ll want the market price to rise above the bid price if you are long, or fall below the ask price if you are short.

Pip

A point in percentage – or pip for short – is a measure of the change in value of a currency pair in the forex market.

It is the smallest possible move that a currency price can change which is the equivalent of a ‘point’ of movement.

What is a forex trader?

A forex trader will hold a ‘position’ in a currency pair. This is the term used to describe a trade in progress and one that will have a profit or a loss, as the open position indicates the trader has some market exposure

Difference between long and short positions

A long position means a trader has bought a currency expecting its value to rise. Once the trader sells that currency back to the market (ideally for a higher price than they paid for it), their long position is said to be ‘closed’ and the trade is complete.

If you wanted to open a long position on the Euro, you would purchase 1 Euro for USD 1.1918. You will then hold your position in the hope that it will appreciate, selling it back to the market at a profit once the price has increased.

A short position refers to a trader who sells a currency expecting its value to fall and plans to buy it back at a lower price. A short position is ‘closed’ once the trader buys back the asset (ideally for less than they sold it for).

In this case, if you think the Euro will weaken against the Dollar, you will sell 1 Euro for USD 1.1916 and hold a short position. You expect the Euro to depreciate and plan to buy it back at a lower rate.

What are the most traded currency pairs on the forex market?

There are seven major currency pairs traded in the forex market, all of which include the US Dollar in the pair.

You can also trade crosses, which do not involve the USD, and exotic currency pairs which are historically less commonly traded (and relatively illiquid).

This means they often come with wider spreads, meaning they’re more expensive than crosses or majors.

Different groups of currency pairs

Major currency pairs

Major currency pairs are generally thought to drive the forex market. They are the most commonly traded and account for over 80% of daily forex trade volume.

There are four traditional majors – EURUSD, GBPUSD, USDJPY and USDCHF – and three known as the commodity pairs – AUDUSD, USDCAD and NZDUSD.

These currency pairs typically have high liquidity, which means they tend to have lower spreads. They are associated with stable, well managed economies and are less prone to slippage, where the expected price of a trade differs from the price the trade was executed at.

Cross currency pairs

Cross currency pairs, known as crosses, do not include the US Dollar. Historically, these pairs were converted first into USD and then into the desired currency – but are now offered for direct exchange.

The most commonly traded are derived from minor currency pairs and can be less liquid than major currency pairs. Examples of the most commonly traded crosses include EURGBP, EURCHF, and EURJPY.

Exotic currency pairs

Exotics are currencies from emerging or developing economies, paired with one major currency.

Compared to crosses and majors, exotics are traditionally riskier to trade because they are more volatile and less liquid. This is because these countries’ economies can be more susceptible to intervention and sudden shifts in political and financial developments.

Join us

Start trading with FXTM

No one makes it easier. Open an account or try our demo account to get started while you build your skills.

Overview of different currency pairs across forex trading and their market nicknames

Majors

EUR/USD «fibre»

USD/JPY «gopher»

GBP/USD «cable»

USD/CHF «swissie»

AUD/USD «aussie»

USD/CAD «loonie»

NZD/USD «kiwi»

Minors

EUR/GBP «chunnel»

EUR/JPY «yuppy»

GBP/JPY «guppy»

NZD/JPY «kiwi yen»

CAD/CHF «loonie swissy»

AUD/JPY

Exotics

USD/MXN

GBP/NOK

GBP/DKK

CHF/NOK

EUR/TRY

USD/TRY

How to trade forex for beginners

There are two main types of analysis that traders use to predict market movements and enter live positions in forex markets – fundamental analysis and technical analysis.

A forex trader will tend to use one or a combination of these to determine a trading style that best fits their personality.

Fundamental analysis

This analysis is interested in the ‘why’ – why is a forex market reacting the way it does? Forex and currencies are affected by many reasons, including a country’s economic strength, political and social factors, and market sentiment.

The biggest fundamental analysis indicators

News and Economic Data

Investors and banks look for strong economies to place their funds, in the expectation that their capital will appreciate. This is because the currency of that country will be in demand as the outlook for the economy encourages more investment. Any news and economic reports which back this up will in turn see traders want to buy that country’s currency.

Central Bank and Government Policy

Central banks determine monetary policy, which means they control things like money supply and interest rates. The tools and policy types used will ultimately affect the supply and demand of their currencies. A government’s use of fiscal policy through spending or taxes to grow or slow the economy may also affect exchange rates.

Technical analysis

Forex traders who use technical analysis study price action and trends on the price charts. These movements can help the trader to identify clues about levels of supply and demand.

The aim of technical analysis is to interpret patterns seen in charts that will help you find the right time and price level to both enter and exit the market.

The three most popular charts in trading

Candlestick Chart

The chart displays the high-to-low range with a vertical line and opening and closing prices. The difference to the bar charts is in the ‘body’ which covers the opening and closing prices, while the candle ‘wicks’ show the high and low.

If the candlestick is filled, then the currency pair closed lower than it opened. If the candlestick is hollow, then the closing price is higher than the opening price.

Bar chart

A bar chart shows the opening and closing prices, as well as the high and low for that period. The top of the bar shows the highest price paid, and the bottom indicates the lowest traded price.

The whole bar represents the currency pair’s whole trading range and the horizontal marks on the sides indicate the opening (left) and the closing prices (right).

Line chart

While a bar chart is commonly used to identify the contraction and expansion of price ranges, a line chart is the simplest of all charts and mostly used by beginners. It simply shows a line drawn from one closing price to the next.

When connected, it is simple to identify a price movement of a currency pair through a specific time period and determine currency patterns.

How to start trading with a forex broker

With FXTM, you can access the forex markets and execute your buy and sell orders through our trading platform.

You should always choose a licensed, regulated broker that has at least five years of proven experience. These brokers will offer you peace of mind as they will always prioritise the protection of your funds. Once you open an active account, you can start trading forex — and you will be required to make a deposit to cover the costs of your trades. This is called a margin account which uses financial derivatives like CFDs to buy and sell currencies.

It is important to remember that trading for beginners isn’t an overnight process. It takes time to become familiar with the markets and there’s a whole new vocabulary to learn. For this reason, FXTM offers a wealth of resources to learn to trade forex. For example, our Demo account is a great way to experiment with different trading strategies – but with virtual money which means with no risk attached!

Once you’re ready to move on to live trading, we’ve also got a great range of trading accounts and online trading platforms to suit you.

Online trading platforms

Forex trading platforms have transformed how people interact with financial markets. They enable investors to easily access hundreds of different markets across the globe.

MetaTrader and FXTM

As a leading global broker, we’re committed to providing flexible services tailored to the needs of our clients. As such, we are proud to offer the most popular trading platforms in the world – MetaTrader 4 (MT4) and MetaTrader 5 (MT5). They are both available on a PC, Mac, mobile or tablet. Our traders can also use the WebTrader version, which means no download is required, while the MT apps for iOS and Android allow you to trade the markets on the go, anytime and anywhere.

You can use all of these platforms to open, close and manage trades from the device of your choice.

Combine tools with MetaTrader

The platforms contain a huge variety of tools, indicators and charts designed to allow you to monitor and analyse the markets in real-time. You can even build strategies to execute your trades using algorithms. Together with innovative services such as FXTM’s Pivot Point tool, Dow Jones insights, and our award-winning Customer Support team, our clients have the resources they need to trade with confidence on the platform of their choice. You can read more and download the trading platforms from our trading platforms page.

Explore trading platforms in more depth

Get all the details you need on MT4 and MT5 by visiting their respective pages.

Learn forex trading

FXTM firmly believes that developing a sound understanding of the markets is your best chance at success as a forex trader. That’s why we offer a vast range of industry-leading educational resources in a variety of languages which are tailored to the needs of both new and more experienced traders.

These include Ebooks, daily market analysis, a variety of videos, and more long read guides just like this one!

There are also many forex tools available to traders such as margin calculators, pip calculators, profit calculators, foreign exchange currency converters, economic data calendars and trading signals.

Forex widgets can help to enhance your trading experience. Some of the most popular widgets include Live Rates Feed, Live Commodities Quotes, Live Indices Quotes, and Market Update widgets.

FREQUENTLY ASKED QUESTIONS

What is trading?

Like with any type of trading, financial market trading involves buying and selling an asset in order to make a profit. This is done on a centralised exchange or over the counter (OTC).

How do I learn forex trading?

Learning to trade as a beginner has become much easier and more accessible than ever before. FXTM has many educational resources available to help you understand the forex market, from tutorials to webinars. Our risk-free demo account also allows you to practice these skills in your own time.

How do I start forex trading?

It’s simple to open a trading account, which means you’ll have your own Account Manager and access to hundreds of markets and resources. It is important to understand the risks involved and to manage this effectively.

Is forex trading profitable?

The aim of forex trading is to exchange one currency for another in the expectation that the price will change in your favour. Currencies are traded in pairs so if you think the pair is going higher, you could go long and profit from a rising market. However, it is vital to remember that trading is risky, and you should never invest more capital than you can afford to lose.

Ready to trade with a world-leading broker?

Open you account in minutes, or log in to continue your trading journey.

Ready to trade with a world-leading broker?

Open you account in minutes, or log in to continue your trading journey.

Any questions? Get in touch – we’re here to help.

Join our community

- Licensed Broker

- Privacy Statement

- Cookie Policy

- Risk Disclosure

- Terms and Conditions

+44 20 3734 1025

Exinity Limited:

Exinity Limited, 5th Floor, 355 NEX Tower, Rue du Savoir, Cybercity, Ebene 72201, Mauritius

Exinity Capital East Africa Ltd:

West End Towers, Waiyaki Way, 6th Floor, P.O. Box 1896-00606, Nairobi, Republic of Kenya

- Accounts Overview & Comparison

- Advantage Account

- Demo Trading

- Performance Statistics

- Commissions and Fees

- Deposits and Withdrawals

FXTM brand is authorized and regulated in various jurisdictions.

ForexTime Ltd (www.forextime.com/eu) with registration number HE 310361 and registration address at 35, Lamprou Konstantara, FXTM Tower, 4156, Kato Polemidia, Limassol, Cyprus is regulated by the Cyprus Securities and Exchange Commission with CIF license number 185/12.

Exinity Capital East Africa Ltd (www.forextime.com) with registration number PVT-ZQU6JE7 and registration address at West End Towers, Waiyaki Way, 6th Floor , P.O. Box 1896-00606, Nairobi, Republic of Kenya is regulated by the Capital Markets Authority of the Republic of Kenya with a Non-Dealing Online Foreign Exchange Broker with license number 135.

Exinity UK Limited (www.forextime.com/uk) with registration number 10599136 and registration address at 1 st. Katharine’s Way London, England, E1W 1UN, UK is authorised and regulated by the Financial Conduct Authority with license number 777911.

Exinity Limited (www.forextime.com) with registration number C119470 C1/GBL and registration address at 5th Floor, NEX Tower, Rue du Savoir, Cybercity, 72201 Ebene, Republic of Mauritius is regulated by the Financial Services Commission of the Republic of Mauritius with an Investment Dealer License with license number C113012295, licensed by the Financial Sector Conduct Authority (FSCA) of South Africa, with FSP No. 50320 and is a licensed Over the Counter Derivative Provider.

Card transactions are processed by Exinity Works (CY) Limited, registered number HE 351684, and registered/business address at Exinity Tower, 35 Lamprou Konstantara, Kato Polemidia, Limassol, 4156, Cyprus. Address for cardholder correspondence: backoffice@fxtm.com.

Risk Warning: Online Forex/CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 81% of retail investor accounts lose money when trading Online Forex/CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. It is the responsibility of the Client to ascertain whether he/she is permitted to use the services of Exinity Capital East Africa Ltd based on the legal requirements in his/her country of residence. Please read FXTM’s full Risk Disclosure.

Regional restrictions FXTM brand does not provide services to residents of the USA, Mauritius, Japan, Canada, Haiti, Iran, Suriname, the Democratic People’s Republic of Korea, Puerto Rico, the Occupied Area of Cyprus, Quebec, Iraq, Syria, Cuba, Belarus and Myanmar. Find out more in the Regulations section of our FAQs.

© 2011 — 2023 FXTM

Risk warning: Trading is risky. Your capital is at risk.

Online Forex/CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 81% of retail investor accounts lose money when trading Online Forex/CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

https://www.investopedia.com/how-to-trade-forex-7499569